Significant milestone reached on HVDC cable

Connecting with another electricity market in Europe could provide Iceland with a unique opportunity to maximise the return from the country’s natural resources:

- Surplus energy already within the system and presently unutilised by industry could be sold.

- Further energy generation methods could be introduced.

- The flexibility of hydropower could be better utilized.

- Risk distribution could be increased.

- Iceland’s energy supply security could be increased by opening up the presently isolated system.

- A number of new and exciting employment opportunities could become a reality and the value created by such a project could be significant.

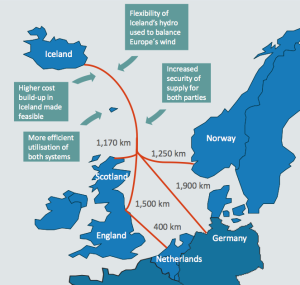

Earlier this summer an advisory group on a subsea HVDC electricity cable between Iceland and Europe handed over its recommendations to the Icelandic Minister of Industries and Innovation. The report shows that there are indications that such a HVDC cable between Iceland and the United Kingdom could prove macro-economically profitable if certain conditions were to be fulfilled; i.e. if negotiations with the counterparties should prove successful, procuring favourable energy prices and secure long term contracts.

Earlier this summer an advisory group on a subsea HVDC electricity cable between Iceland and Europe handed over its recommendations to the Icelandic Minister of Industries and Innovation. The report shows that there are indications that such a HVDC cable between Iceland and the United Kingdom could prove macro-economically profitable if certain conditions were to be fulfilled; i.e. if negotiations with the counterparties should prove successful, procuring favourable energy prices and secure long term contracts.

The recommendations of the advisory group are a significant milestone in assessing the feasibility of connecting Iceland with the European electricity market. The advisory group was unanimous in its opinion that work should continue on mapping out the various aspects of the project domestically whilst concurrently seeking out answers on potential operational and ownership models from the counterparties in the UK.

The risk of domestic electricity prices multiplying, with a connection with European markets, seems to be minimal. The Norwegians have set a successful precedent for achieving the consensus of stakeholders whilst utilising the opportunity to sell electricity to the European market. This has been done without threatening the existence of industry within Norway.

The Minister of Industries and Innovation will assess the recommendations of the advisory group and come to a decision as to the next step. It is estimated that the preliminary findings will be released by the end of this year (2013). This will include a decision on if and when expensive and extensive detailed research on the project will begin.

The Minister of Industries and Innovation will assess the recommendations of the advisory group and come to a decision as to the next step. It is estimated that the preliminary findings will be released by the end of this year (2013). This will include a decision on if and when expensive and extensive detailed research on the project will begin.