The pricing policy of Landsvirkjun

This article focuses on the pricing policy of the Icelandic national power company Landsvirkjun. Although starting price in recent new contracts seems to have been between 25-35 USD/MWh, we may expect higher tariffs in the future. Due to rising cost of new power plants in Iceland, it seems likely that from now the normal starting price in new electricity contracts will be close to 35 USD/MWh, rising towards 40 USD/MWh.

Wholesale power company

Landsvirkjun produces close to 75% of all electricity generated in Iceland. The company sells most of this electricity directly to four large consumers; three aluminum smelters and one ferro-silicon plant. Landsvirkjun also has contracts with smaller consumers, such as other types of industrial plants and data centers. Finally, substantial part of the generation is sold in wholesale-contracts to other power companies, for resale on the general power market.

“Headline rate of 43 USD/MWh”

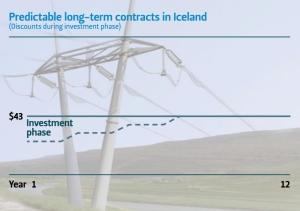

According to Landsvirkjun’s website the company is “committed to offering competitive electricity contracts, based on the European electricity market, by offering long-term agreements, favourable prices and an unparalleled security of supply.” Landsvirkjun has since 2011 offered 12 year power contracts with a headline rate of 43 USD/MWh. Landsvirkjun has also expressed that the company offers electricity-contracts at a fixed real price of 43 USD/MWh, with discounts for selected greenfield projects.

According to Landsvirkjun’s website the company is “committed to offering competitive electricity contracts, based on the European electricity market, by offering long-term agreements, favourable prices and an unparalleled security of supply.” Landsvirkjun has since 2011 offered 12 year power contracts with a headline rate of 43 USD/MWh. Landsvirkjun has also expressed that the company offers electricity-contracts at a fixed real price of 43 USD/MWh, with discounts for selected greenfield projects.

New customers offered starting tariff between 25-35 USD/MWh

These general statements by Landsvirkjun do not make it very clear what tariffs Landsvirkjun offers. We can assume though, that Landsvirkjun aims at a price close to 43 USD/MWh, arguably indexed to inflation within European Union (and/or within United States / Canada, as Landsvirkjun sometimes refers to these countries as their competitive markets). Still, it is somewhat unclear what tariffs new customers may expect from Landsvirkjun.

What we do know, is that new customers of Landsvirkjun are offered power tariffs starting well below the said 43 USD/MWh. We also know that this lower tariff may extend for a period of at least five to seven years, as described in a presentation in 2012 by the current CEO of Landsvirkjun.

What we do know, is that new customers of Landsvirkjun are offered power tariffs starting well below the said 43 USD/MWh. We also know that this lower tariff may extend for a period of at least five to seven years, as described in a presentation in 2012 by the current CEO of Landsvirkjun.

So what are the tariffs offered to new customers for the first five to seven years? According to information we have from the data centre services in Iceland, starting price in such contracts seem to be close to or somewhat below 35 USD/MWh. In larger contracts, such as with the new silicon industry in Iceland, Landsvirkjun seems to have been offering a starting tariff below 30 USD/MWh. In general we can assume that recent starting tariff to Landsvirkjun’s new customers has in general been somewhere between 25-35 USD/MWh (the transmission cost is not included).

Tariff in renegotiated large contracts is probably close to 30 USD/MWh

During the last few years Landsvirkjun has renegotiated with two of the aluminum smelters located in Iceland. According to analysis by Askja Energy Partners, the power tariff to the Straumsvík smelter is approaching 35 USD/MWh. Note that the transmission cost is included in this price, which means that the smelter in Straumsvík (Rio Tinto Alcan / ÍSAL) is currently paying Landsvirkjun close to or slightly below 30 USD/MWh (without the transmission cost). This tariff is linked to the US consumer price index (CPI).

Landsvirkjun’s new tariff negotiated with the aluminum smelter of Norðurál at Grundartangi is set up by a very different method, as it is aligned to market price of electricity on the Nordic power market. The new tariff for Norðurál (Century Aluminum) goes into effect in 2019. When looking at the current monthly market price at the Nord Pool Spot we can assume that from 2019 Norðurál will be paying Landsvirkjun close to 30 USD/MWh when the transmission cost is not taken inro account. Thus it may be fair to say, that Landsvirkjun’s wholesale tariff in renegotiated large contracts is close to 30 USD/MWh.

Landsvirkjun’s new tariff negotiated with the aluminum smelter of Norðurál at Grundartangi is set up by a very different method, as it is aligned to market price of electricity on the Nordic power market. The new tariff for Norðurál (Century Aluminum) goes into effect in 2019. When looking at the current monthly market price at the Nord Pool Spot we can assume that from 2019 Norðurál will be paying Landsvirkjun close to 30 USD/MWh when the transmission cost is not taken inro account. Thus it may be fair to say, that Landsvirkjun’s wholesale tariff in renegotiated large contracts is close to 30 USD/MWh.

Tariffs are sometimes linked to product prices

Tariffs in new power contracts by Landsvirkjun are probably in general indexed to price inflation (such as in USA or EU). Also it is likely that the contracts include fixed price increase after five to seven years, resulting in tariffs heading towards 40 USD/MWh (and possibly towards the advertised 43 USD/MWh). This, however, does not apply to renegotiated contracts with heavy industries such as aluminum smelters, where the tariffs are either aligned with the power price on the Nordic market or consumer price index in the USA.

In recent years, the management of Landsvirkjun has repeatedly expressed that the company wants to move away from power contracts having tariff linked to the price of aluminum (or other relevant products such as ferrosilicon). However, it seems clear that Landsvirkjun is sometimes still open to such product-pricing methods. According to information from the EFTA Surveillance Authority (ESA), the new silicon plant of PCC in Iceland seems to have its power price linked to the price of silicon metal.

Strong demand and rising costs of new power plants will push tariffs up

Due to strong demand for electricity, the Icelandic power market is currently a sellers-market. Furthermore, it is hardly possible to construct a new power plant in Iceland unless the electricity can be sold at an average price close to at least 35 USD/MWh. Of course this means that when offering a 12 year contracts, Landsvirkjun may be able to offer lower starting price if the tariff will rise towards 40 USD/MWh after approximately five years or so. But in general we can expect that due to the strong demand for electricity in Iceland and rising cost of new power plants in the country, the general wholesale power prices will in general not be lower than 35 USD/MWh and even soon be heading towards 40 USD/MWh. In fact the general wholesale price for electricity in Iceland in 2016 was close to 38 USD/MWh.