The IceLink subsea interconnector is a proposed power cable that would connect the power markets of Iceland and Great Britain (UK). On the website of Icelandic national power company Landsvirkjun, the rational for the IceLink cable is described. In this article we will fact-check this rationale:

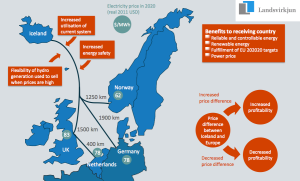

Claim no.1: IceLink lifts the isolation of the Icelandic electricity market and it assists Europe to achieve interconnection capacity targets amounting to 10% of installed capacity, and it opens up new markets for both Icelandic and UK suppliers.

- Correct: The Icelandic power market is isolated. With IceLink, that would change.

- Correct: IceLink would be part of Europe’s projects to achieve interconnection capacity targets.

- Correct: IceLink do open up new markets for Icelandic and UK suppliers.

The EU Commission has set a target of 10% electricity interconnection by 2020. This means that all EU countries should construct electricity cables that allow at least 10% of the electricity produced by their power plants to be transported across its borders to its neighboring countries. However, IceLink will not be ready by 2020. Thus, it seems likely that the IceLink project would rather become a part of EU’s new energy policy and targets for 2030. In fact, this development or process has already started.

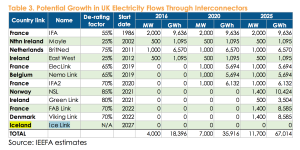

The EU Commission has already proposed to extend the interconnection target from 19% to 15% by 2030. The targets will be reached through the implementation of Projects of Common Interest. A new special expert group on electricity interconnection targets established by the EU Commission had its first meeting in Brussels on 17th and 18th October 2016. It is yet to be seen what will become the new interconnection target for each of the EU member states, but so far the UK’s share is only less than 5%. In 2015 domestic installed capacity in GB was 91 GW, while total capacity of interconnectors between UK and other countries was 4 GW.

The EU Commission has already proposed to extend the interconnection target from 19% to 15% by 2030. The targets will be reached through the implementation of Projects of Common Interest. A new special expert group on electricity interconnection targets established by the EU Commission had its first meeting in Brussels on 17th and 18th October 2016. It is yet to be seen what will become the new interconnection target for each of the EU member states, but so far the UK’s share is only less than 5%. In 2015 domestic installed capacity in GB was 91 GW, while total capacity of interconnectors between UK and other countries was 4 GW.

Regarding IceLink opening up new markets, it should be noted that the general power market in Iceland is very small compared to GB or UK. Thus, for suppliers in the UK the Icelandic power market is probably not very interesting. However, it might be positive for suppliers of wind energy in Scotland to have access to Iceland, as we will now explain:

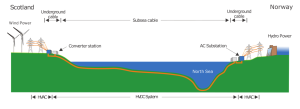

Claim no.2: Through bi-directional flows, IceLink could potentially reduce the cost of managing constraints between northern GB and the major consumption centres further south as energy is directed to Iceland at times of excess wind power generation in the north, stored in hydro reservoirs, and returned at times of lower wind output.

- Correct: IceLink would open up the possibility to store for example Scottish wind power in Iceland’s reservoirs.

- Correct: During time of low wind in Scotland, Icelandic hydropower stations could be utilized to bring the wind power back to Scotland.

Claim no.3: By providing flexible energy in near term spot markets and the balancing mechanism, IceLink can lower the cost of balancing, in particular in a system with a high penetration of intermittent generation.

- Possibly: There is a possibility that IceLink would lower the cost of balancing electricity supply/demand. However, this of course depends on several factors, such as the British capacity market.

Claim no.4: IceLink connects currently isolated Iceland´s renewable electricity system with the broader European system and offers a means to decrease Europe´s dependency on imported fossil fuels in a cost efficient way.

- Correct, but not very relevant: IceLink is expected to offer the UK (and thus the European system) access to approx. 5,000 GWh annually. The current total annual electricity consumption in the UK is close to 335,000 GWh. Access to power generated in Iceland would thus only add a fraction to the current power supplied and consumed in the UK.

However, note that in 2015 the renewable power generation in the UK was close to 83 TW, so an addition of 5 TWh of renewable generation is substantial. This of course means that IceLink would in fact make UK (and Europe) a little bit less dependent on power from for example coal and natural gas (fossil fuels)

Claim no.5: IceLink increases diversity of power supply at both ends and enhances further deployment of renewables through coupling highly flexible hydro generation with that of intermittent wind and solar generation.

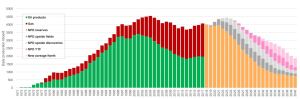

- Correct: Iceland and UK utilize different sources for their power generation. While UK is mainly dependent on natural gas, coal and nuclear energy for its power generation, Iceland utilizes hydro and geothermal for close to all its generation. Moreover, most of the generation in Iceland comes from hydro. IceLink will thus indeed increase diversity of the power supply, and Iceland’s flexible hydro power is perfect to balance supply and demand while solar and wind power fluctuates.

Claim no.6: IceLink delivers reliable and flexible energy into the GB system at times of thin supply margins.

- Correct: IceLink could indeed deliver reliable and flexible energy into the GB/UK system at times of thin supply margins. To better understand the importance of access to flexible hydropower, based on large reservoirs, we would like to refer to our earlier article; IceLink offers flexibility rather than base load power.

Claim no.7: IceLink allows energy to flow to Iceland at times of low hydro generation potential, e.g. due to unusually low precipitation levels.

- Correct: Every few years, the Icelandic reservoirs fill up quite late due to low precipitation or cold weather (resulting in low glacial melting). This decreases the efficiency of the Icelandic hydropower stations and adds a risk to the system. With IceLink this risk would become less.

Claim no.8: Iceland generation is 100% renewable. The interconnector would provide an export opportunity for the surplus energy in the renewable hydro system that is not currently harnessed due to economical and operational limitations.

- Correct: The closed Icelandic electricity system is constructed in the manner of securing stable supply to heavy industries (especially to aluminum smelters, who need stable power supply 24/7 all year around). In years with unusually much precipitation or heavy glacial melting (warm periods), excess amounts of water runs into the reservoirs, resulting in overflow. Turbines could be added to harness this excess, but such development is costly and not economic unless having access to a market where power prices are higher than in Iceland. IceLink would create access to such a market.

Claim no.9: The UK has committed itself to ambitious reduction of greenhouse gas emissions. IceLink contributes with its lower cost of low carbon energy compared to domestic marginal alternatives and its flexibility contributes to reducing the cost of enabling the integration of UK intermittent renewables.

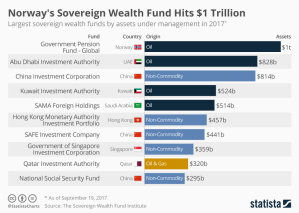

- Correct: Even though the Icelandic geothermal,- hydro- and wind power sources are fairly limited when having regard to the enormous size of the British power market, it would make economic sense for the UK to buy Icelandic renewable power instead of for example more expensive British offshore wind power. For more on this subject, we refer to our earlier article; UK’s electricity strike prices positive for IceLink. And we can add that even though strike prices for new offshore wind power seems to be coming down quite fast, electricity from Iceland could be substantially cheaper than new offshore wind farms off the British coast.

Claim no.10: IceLink involves the deployment of relatively mature low carbon technologies. As such, it allows GB to reduce reliance on particular domestic technologies, thereby reducing exposure to lower than expected cost reduction trajectories.

- Correct: Currently, almost all power generation in Iceland comes from mature geothermal- and hydro technology. In the coming years and decades the Icelandic power sector is likely to also start utilizing wind power on land – which is also a mature technology and less problematic than offshore wind power.

The conclusion is that most of the claims set forward by Landsvirkjun, regarding IceLink, are not only correct but also very relevant. However, it is possible that the project could be delayed by Britain’s decision to leave the European Union.

The Norwegian wind power developer Zephyr has established a wind energy firm in Iceland; Zephyr Iceland. The company intends to invest considerable funds in research on Icelandic wind conditions, with the aim of constructing wind farms in the coming years, offering new type of renewable power at competitve prices.

The Norwegian wind power developer Zephyr has established a wind energy firm in Iceland; Zephyr Iceland. The company intends to invest considerable funds in research on Icelandic wind conditions, with the aim of constructing wind farms in the coming years, offering new type of renewable power at competitve prices.