Upcoming power projects in Iceland

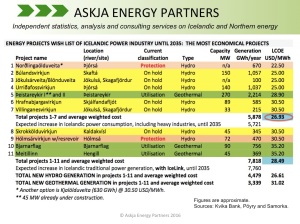

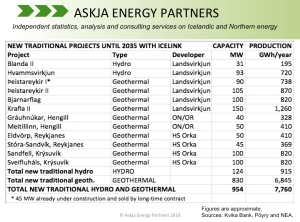

The following list explains what power projects are being considered in Iceland, according to the Icelandic Master Plan for Nature Protection and Energy Utilization. The projects have been cost analyzed (levelized cost of energy; LCOE), as described in a recent report published by the Icelandic Energy Industry Association (Samorka).

The projects are classified into three different groups (not all the possibilities have been officially cost-analyzed):

Utilization category: The project is likely to be developed if/when there is power demand and interest by the energy sector.

Projects on hold: More information and/or data is needed to decide if the project will be classified as Utilization or Protection.

Protection category: The project is unlikely to be developed, due to environmental issues.

The current classification is being reconsidered by the government However, it is the Icelandic Parliament (Alþingi) that takes final decision regarding how each project is categorized. This means that over time, project(s) may be moved from one category to another, based on a political decision by the Parliament. The following classification is up to date as of August 2016. Note that in Samorka’s report on the LCOE, the cheapest option, Norðlingaölduveita, is said to be on hold. In fact this option is currently in the protection category.

| Project name | Current | Type | MW | Annual | LCOE | |

| classification | GWh | USD/MWh | ||||

| 1 | Norðlingaölduveita* | Protection | Hydro | n/a | 670 | 22.50 |

| 2 | Búlandsvirkjun | On hold | Hydro | 150 | 1,057 | 25.00 |

| 3 | Jökulsárveita/Blönduveita | On hold | Hydro | n/a | 100 | 25.00 |

| 4 | Urriðafossvirkjun | On hold | Hydro | 140 | 1,037 | 25.00 |

| 5 | Þeistareykir I** and II | Utilisation | Geothermal | 270 | 2,214 | 28.90 |

| 6 | Hrafnabjargavirkjun* | On hold | Hydro | 89 | 585 | 30.50 |

| 7 | Villinganesvirkjun | On hold | Hydro | 33 | 215 | 30.50 |

| 8 | Skrokkölduvirkjun | On hold | Hydro | 45 | 345 | 30.50 |

| 9 | Hólmsárvirkjun* | Protection | Hydro | 72 | 470 | 30.50 |

| 10 | Bjarnarflag | Utilisation | Geothermal | 90 | 756 | 35.20 |

| 11 | Meitillinn | Utilisation | Geothermal | 45 | 369 | 35.20 |

| 12 | Sandfell | Utilisation | Geothermal | 100 | 820 | 35.20 |

| 13 | Sveifluháls | Utilisation | Geothermal | 100 | 820 | 35.20 |

| 14 | Austurengjar | On hold | Geothermal | 100 | 820 | 35.20 |

| 15 | Gjástykki | On hold | Geothermal | 50 | 420 | 35.20 |

| 16 | Trölladyngja | On hold | Geothermal | 100 | 820 | 35.20 |

| 17 | Bitra | Protection | Geothermal | 135 | 1,100 | 35.20 |

| 18 | Brennisteinsfjöll | Protection | Geothermal | 90 | 711 | 35.20 |

| 19 | Hvammsvirkjun | Utilisation | Hydro | 93 | 720 | 38.80 |

| 20 | Búðartunguvirkjun | On hold | Hydro | 27 | 230 | 38.80 |

| 21 | Hagavatnsvirkjun | On hold | Hydro | 20 | 120 | 38.80 |

| 22 | Holtavirkjun | On hold | Hydro | 57 | 450 | 38.80 |

| 23 | Hraunavirkjun* | On hold | Hydro | 126 | 731 | 38.80 |

| 24 | Selfossvirkjun | On hold | Hydro | 35 | 258 | 38.80 |

| 25 | Stóra-Laxárvirkjun | Unclassified | Hydro | 35 | 200 | 38.80 |

| 26 | Tungnaárlón | On hold | Hydro | n/a | 70 | 38.80 |

| 27 | Bláfellsvirkjun | Protection | Hydro | 89 | 516 | 38.80 |

| 28 | Djúpárvirkjun | Protection | Hydro | 86 | 499 | 38.80 |

| 29 | Markarfljótsvirkjun | Protection | Hydro | 121 | 702 | 38.80 |

| 30 | Gráuhnúkar | Utilisation | Geothermal | 45 | 369 | 44.80 |

| 31 | Eldvörp | Utilisation | Geothermal | 50 | 410 | 44.80 |

| 32 | Hverahlíð | Utilisation | Geothermal | 90 | 738 | 44.80 |

| 33 | Krafla II | Utilisation | Geothermal | 150 | 1,260 | 44.80 |

| 34 | Stóra-Sandvík | Utilisation | Geothermal | 50 | 410 | 44.80 |

| 35 | Botnafjöll | On hold | Geothermal | 90 | 711 | 44.80 |

| 36 | Fremrinámar | On hold | Geothermal | 100 | 840 | 44.80 |

| 37 | Grashagi | On hold | Geothermal | 90 | 711 | 44.80 |

| 38 | Hágönguvirkjun | On hold | Geothermal | 150 | 1,260 | 44.80 |

| 39 | Innstidalur | On hold | Geothermal | 45 | 369 | 44.80 |

| 40 | Sandfell | On hold | Geothermal | 90 | 711 | 44.80 |

| 41 | Þverárdalur | On hold | Geothermal | 90 | 738 | 44.80 |

| 42 | Grændalur | Protection | Geothermal | 120 | 984 | 44.80 |

| 43 | Hverabotn | Protection | Geothermal | 90 | 711 | 44.80 |

| 44 | Kisubotnar | Protection | Geothermal | 90 | 711 | 44.80 |

| 45 | Neðri-Hveradalir | Protection | Geothermal | 90 | 711 | 44.80 |

| 46 | Þverfell | Protection | Geothermal | 90 | 711 | 44.80 |

| 47 | Blanda II | Utilisation | Hydro | 31 | 194 | 49.70 |

| 48 | Hvalárvirkjun | Utilisation | Hydro | 55 | 320 | 49.70 |

| 49 | Austurgilsvirkjun | On hold | Hydro | 35 | 228 | 49.70 |

| 50 | Blöndudalsvirkjun | On hold | Hydro | 16 | 92 | 49.70 |

| 51 | Brúarárvirkjun | On hold | Hydro | 23 | 133 | 49.70 |

| 52 | Hafrálónsárvirkjun efri | On hold | Hydro | 15 | 87 | 49.70 |

| 53 | Hafrálónsárvirkjun neðri | On hold | Hydro | 78 | 452 | 49.70 |

| 54 | Haukholtavirkjun | On hold | Hydro | 17 | 99 | 49.70 |

| 55 | Hestvatnsvirkjun | On hold | Hydro | 34 | 197 | 49.70 |

| 56 | Hofsárvirkjun | On hold | Hydro | 39 | 226 | 49.70 |

| 57 | Hverfisfljótsvirkjun | On hold | Hydro | 42 | 243 | 49.70 |

| 58 | Hvítá við Norðurreyki | On hold | Hydro | 14 | 82 | 49.70 |

| 59 | Kaldbaksvirkjun | On hold | Hydro | 47 | 273 | 49.70 |

| 60 | Kljáfossvirkjun | On hold | Hydro | 16 | 93 | 49.70 |

| 61 | Núpsárvirkjun | On hold | Hydro | 71 | 412 | 49.70 |

| 62 | Reyðarvatnsvirkjun | On hold | Hydro | 14 | 82 | 49.70 |

| 63 | Skatastaðavirkjun* | On hold | Hydro | 156 | 1,090 | 49.70 |

| 64 | Vatnsdalsárvirkjun | On hold | Hydro | 28 | 162 | 49.70 |

| 65 | Gýgarfossvirkjun | Protection | Hydro | 22 | 128 | 49.70 |

| 66 | Bakkahlaup | On hold | Geothermal | 15 | 119 | 57.30 |

| 67 | Hrúthálsavirkjun | On hold | Geothermal | 20 | 160 | 57.30 |

| 68 | Hveravallavirkjun | On hold | Geothermal | 10 | 79 | 57.30 |

| 69 | Reykjabólsvirkjun | On hold | Geothermal | 10 | 79 | 57.30 |

| 70 | Sandfellsvirkjun | On hold | Geothermal | 10 | 79 | 57.30 |

| 71 | Sköflungsvirkjun | On hold | Geothermal | 90 | 711 | 57.30 |

| 72 | Seyðishólavirkjun | On hold | Geothermal | 10 | 79 | 57.30 |

| 73 | Fljótshnjúksvirkjun | On hold | Hydro | 58 | 405 | 60.50 |

| 74 | Vörðufellsvirkjun | On hold | Hydro | 58 | 174 | 60.50 |

| 75 | Glámuvirkjun | On hold | Hydro | 67 | 400 | nyca |

| 76 | Arnardalsvirkjun* | Protection | Hydro | 587 | 3,404 | nyca |

| 77 | Bjallavirkjun | Protection | Hydro | 46 | 310 | nyca |

| 78 | Blöndulundur | Unclassified | Wind | 100 | 350 | nyca |

| 79 | Búrfellslundur | Unclassified | Wind | 200 | 705 | nyca |

| Notes: | |

| * | The project may be developed in a different way for less environmental impacts, resulting in lower generation. |

| ** | 45 MW station at Þeistareykir is already under construction, with the electricity sold (long-term contract). |

| n/a | Projects involving new reservoir for current power stations (turbines may be added, but not necessarily). |

| nyca | Projects that have not yet been officially cost-analyzed. |

———————————————————————————-

The list above may change at any time and new projects not listed may be introduced and developed.

Planned 45 MW wind power project of Biokraft in Southern Iceland is not included on the list.

No planned power projects under 10 MW (mainly small hydro) are included on the list.

Cost estimates do not include transmission or connection cost.

The list is up to date @ August 2016.