Oil exploration at Dreki on hold

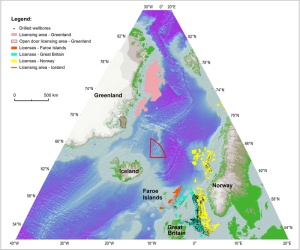

Five years ago, when the Icelandic National Energy Agency (NEA) granted two licences for oil exploration to Faroe Petroleum and Valiant Petroleum (now part of Canadian Ithaca Energy), there were high hopes this would be the start of an Icelandic oil adventure. The optimism even increased a year later, when the Chinese giant CNOOC became operator in a third license.

Now all the three licenses at the Dreaki-area have been relinquished by the operators, putting oil exploration in Icelandic jurisdiction on hold. The reason for the waning interest in the area is low likelihood of finding commercially recoverable hydrocarbons. The area is extremely complex in terms of geology, making project evaluation difficult. As described by Norwegian Petoro, “[v]olcanic activity in the area camouflages seismic responses to some extent, and has contributed to very intense heat, which creates major challenges for both potential hydrocarbon sources and reservoir quality.”

At this stage it is unclear what steps the Icelandic NEA will take regarding the oil exploration, such as if the agency will start a new licensing round. It should be noted that one of the partners in the license hold by CNOOC as operator, is still holding on the license, trying to find new qualified partner(s). Those who may be interested in stepping into the license, should contact Eykon Energy. Those who seek, find – perhaps!