Aluminum smelters of the World (outside of China)

The aluminum industry has for years been plagued by over-capacity, often resulting in to much supply and depressed aluminum prices. The situation has lead to closure of number of smelters, not least in Brazil and in the United States. Several smelters are currently not being utilised at full capacity, which has limited the over-supply.

Below is a list of all the primary aluminum smelters in the world outside of China, listed by countries in alphabetical order. Soon we at the Independent Icelandic and Northern Energy Portal, will also be presenting a list of smelters in China, which will put the limelight on the much more severe over-capacity in the Chinese aluminum sector.

Given figures are for 2019. Main sources are annual reports for individual companies, information as presented by the International Aluminum Institute, and research by Askja Energy Partners. In some cases the presented information may not be exact, due to lack of reliable information. However, we are confident that this is currently (Sept 2020) the most accurate publicly available list of its kind.

| No. | Country | Location | Capacity* | Owner** |

| 1 | Argentina | Puerto Madryn | 470.000 | Aluar |

| 2 | Australia | Boyne Isl., Queensl. | 545.000 | Rio Tinto (JV) |

| 3 | Australia | Tomago, NSW | 585.000 | Rio Tinto (JV) |

| 4 | Australia | Portland, Victoria | 358.000 | Alcoa (JV) |

| 5 | Australia | Kurri Kurri, NSW | 180.000 | Norsk Hydro |

| 6 | Australia | Bell Bay, Tasmania | 189.000 | Rio Tinto |

| 7 | Azerbaijan | Ganja | 50.000 | Ganja Aluminum |

| 8 | Bahrain | Askar | 1.540.000 | Alba |

| 9 | Bosnia and Herzegovina | Mostar | 130.000 | Aluminij Mostar (JV) |

| 10 | Brazil | São Luís | 465.000 | Alumar |

| 11 | Brazil | Vila dos Cabanos | 460.000 | Albras |

| 12 | Brazil | Sorocaba | 455.000 | CBA |

| 13 | Brazil | Ouro Preto | 150.000 | Hindustan Alum. (JV) |

| 14 | Brazil | Poços de Caldas | 106.000 | Alcoa |

| 15 | Brazil | Santa Cruz | 95.000 | Metalisul |

| 16 | Brazil | Saramenha | 51.000 | Novelis do Brasil |

| 17 | Cameroon | Edéa | 100.000 | Rio Tinto (JV) |

| 18 | Canada | Kitimat, BC | 420.000 | Rio Tinto |

| 19 | Canada | Sept-Iles, QC | 600.000 | Rio Tinto (JV) |

| 20 | Canada | Arvida, QC | 230.000 | Rio Tinto |

| 21 | Canada | Grande Baie, QC | 235.000 | Rio Tinto |

| 22 | Canada | Laterrière, QC | 240.000 | Rio Tinto |

| 23 | Canada | Alma, QC | 470.000 | Rio Tinto |

| 24 | Canada | Bécancour, QC | 455.000 | Acoa (JV) |

| 25 | Canada | Baie Comeau, QC | 300.000 | Alcoa |

| 26 | Canada | Deschambault, QC | 285.000 | Alcoa |

| 27 | Egypt | Nag Hammadi | 320.000 | Egyptalum |

| 28 | France | Dunkerque | 285.000 | Liberty Aluminium |

| 29 | France | St. Jean de Maurienne | 145.000 | Trimet Aluminium (JV) |

| 30 | Germany | Neuss | 230.000 | Norsk Hydro |

| 31 | Germany | Voerde | 96.000 | Trimet Aluminium |

| 32 | Germany | Hamburg | 135.000 | Trimet Aluminium |

| 33 | Germany | Essen | 170.000 | Trimet Aluminium |

| 34 | Ghana | Tema | 200.000 | Valco |

| 35 | Greece | St. Nicolas | 170.000 | Aluminium de Grèce |

| 36 | Guinea | Sangaredi | N/A | South32 (JV) |

| 37 | Iceland | Reyðarfjörður | 346.000 | Alcoa |

| 38 | Iceland | Grundartangi | 312.000 | Century Aluminum |

| 39 | Iceland | Straumsvik | 210.000 | Rio Tinto |

| 40 | India | Korba | 570.000 | Vedanta Resources |

| 41 | India | Jharsuguda | 1.750.000 | Vedanta Resources |

| 42 | India | Angul | 475.000 | Nalco |

| 43 | India | Hirakud | 213.000 | Hindalco |

| 44 | India | Renukoot | 345.000 | Hindalco |

| 45 | India | Lapanga | 360.000 | Hindalco |

| 46 | India | Bargawan | 360.000 | Hindalco |

| 47 | India | Belgaum, Karnataka | 390.000 | Hindalco |

| 48 | Indonesia | Kuala Tanjung | 265.000 | Inalum |

| 49 | Iran | Arak (1 &2) | 180.000 | Iralco |

| 50 | Iran | Bandar Abbas 1 | 110.000 | Al-Mahdi Aluminium |

| 51 | Iran | Bandar Abbas (2) | 147.000 | Hormozal |

| 52 | Italy | Portoscuso | 159.000 | Alcoa |

| 53 | Kazakhstan | Pavlodar | 250.000 | Kazakhstan Aluminum |

| 54 | Malaysia | Mukah | 120.000 | Press Metal |

| 55 | Malaysia | Samalaju | 323.000 | Press Metal |

| 56 | Montenegro | Podgorica | 75.000 | Uniprom KAP |

| 57 | Mozambique | Maputo | 565.000 | Mozal |

| 58 | Netherlands | Delfzijl | 180.000 | Aldel |

| 59 | New Zealand | Tiwai Point | 360.000 | Rio Tinto (JV) |

| 60 | Nigeria | Ikot Abasi | 200.000 | Alscon |

| 61 | Norway | Høyanger | 64.000 | Norsk Hydro |

| 62 | Norway | Husnes | 185.000 | Norsk Hydro |

| 63 | Norway | Karmøy | 275.000 | Norsk Hydro |

| 64 | Norway | Årdal | 204.000 | Norsk Hydro |

| 65 | Norway | Sunndal | 400.000 | Norsk Hydro |

| 66 | Norway | Lista | 127.000 | Alcoa |

| 67 | Norway | Mosjøen | 222.000 | Alcoa |

| 68 | Oman | Sohar | 390.000 | Sohar |

| 69 | Qatar | Mesaieed | 645.000 | Qatalum |

| 70 | Romania | Slatina | 282.000 | Alro Slatina |

| 71 | Russia | Boguchany | 600.000 | Rusal |

| 72 | Russia | Bratsk | 1.020.000 | Rusal |

| 73 | Russia | Kandalaksha | 72.000 | Rusal |

| 74 | Russia | Khakas | 300.000 | Rusal |

| 75 | Russia | Krasnoyarsk | 1.025.000 | Rusal |

| 76 | Russia | Novokuznetsk | 215.000 | Rusal |

| 77 | Russia | Sayanogorsk | 545.000 | Rusal |

| 78 | Russia | Shelekhovo | 420.000 | Rusal |

| 79 | Russia | Volgograd | 70.000 | Rusal |

| 80 | Saudi Arabia | Ras Al Khair | 740.000 | Ma’aden |

| 81 | Slovakia | Ziar nad Hronom | 175.000 | Slovalco |

| 82 | Slovenia | Kidricevo | 85.000 | Talum |

| 83 | South Africa | Richards Bay, Hillside | 720.000 | South32 |

| 84 | South Africa | Richards Bay, Bayside | 100.000 | South32 |

| 85 | Spain | San Ciprian | 250.000 | Alcoa |

| 86 | Spain | Aviles | 93.000 | Alcoa |

| 87 | Spain | La Coruna | 87.000 | Alcoa |

| 88 | Sweden | Sundsvall | 130.000 | Kubal |

| 89 | Tajikistan | Tursunzoda | 450.000 | Talco |

| 90 | Turkey | Seydisehir | 82.000 | Eti Alüminyum |

| 91 | UAE | Jebel Ali, Dubai | 1.160.000 | Dubal |

| 92 | UAE | Taweelah, Abu Dhabi | 1.500.000 | Emal |

| 93 | Ukraine | Zaporozhye | 120.000 | Zalk |

| 94 | United Kingdom | Burntisland | 120.000 | Rio Tinto |

| 95 | United Kingdom | Fort William | 42.000 | Rio Tinto |

| 96 | United Kingdom | Holyhead | 142.000 | Rio Tinto |

| 97 | USA | Hawesville, KT | 250.000 | Century Aluminum |

| 98 | USA | Mount Holly, NC | 229.000 | Century Aluminum |

| 99 | USA | Sebree, KY | 220.000 | Century Aluminum |

| 100 | USA | Ravenswood, WV | 180.000 | Century Aluminum |

| 101 | USA | Columbia Falls, MT | 180.000 | Glencore |

| 102 | USA | Evansville. IN | 161.000 | Alcoa |

| 103 | USA | Newburgh, IN | 270.000 | Alcoa |

| 104 | USA | Wenatchee, WA | 144.000 | Alcoa |

| 105 | USA | Ferndale, MT | 279.000 | Alcoa |

| 106 | USA | Massena, NY | 135.000 | Alcoa |

| 107 | USA | St. Lawrence, NY | 125.000 | Alcoa |

| 108 | USA | Rockdale, TX | 176.000 | Alcoa |

| 109 | USA | Goldendale, WA | 172.000 | Goldendale Aluminum |

| 110 | USA | New Madrid, MO | 280.000 | Magnitude 7 Metals |

| 111 | USA | Hannibal, OH | 270.000 | Ormet |

| 112 | Venezuela | Matanzas | 448.000 | Venalum |

| 113 | Venezuela | Puerto Ordaz | 170.000 | Alcasa |

| 114 | Vietnam | Lam Dong | 600.000 | Vinacomin |

| Total capacity | 36.526.000 | |||

| Closed capacity | 5.002.000 | |||

| Total operational capacity | 31.524.000 | |||

| Idled capacity | 11% | 3.622.000 | ||

| Total production | 89% | 27.902.000 | ||

* Capacity in tonnes/year.

** Parent company (or strategically important owner, if joint venture).

Capacity figures in red mean the smelter has been closed.

Some of the other smelters are not operated at full capacity.

All numbers are in European format.

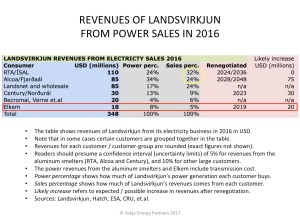

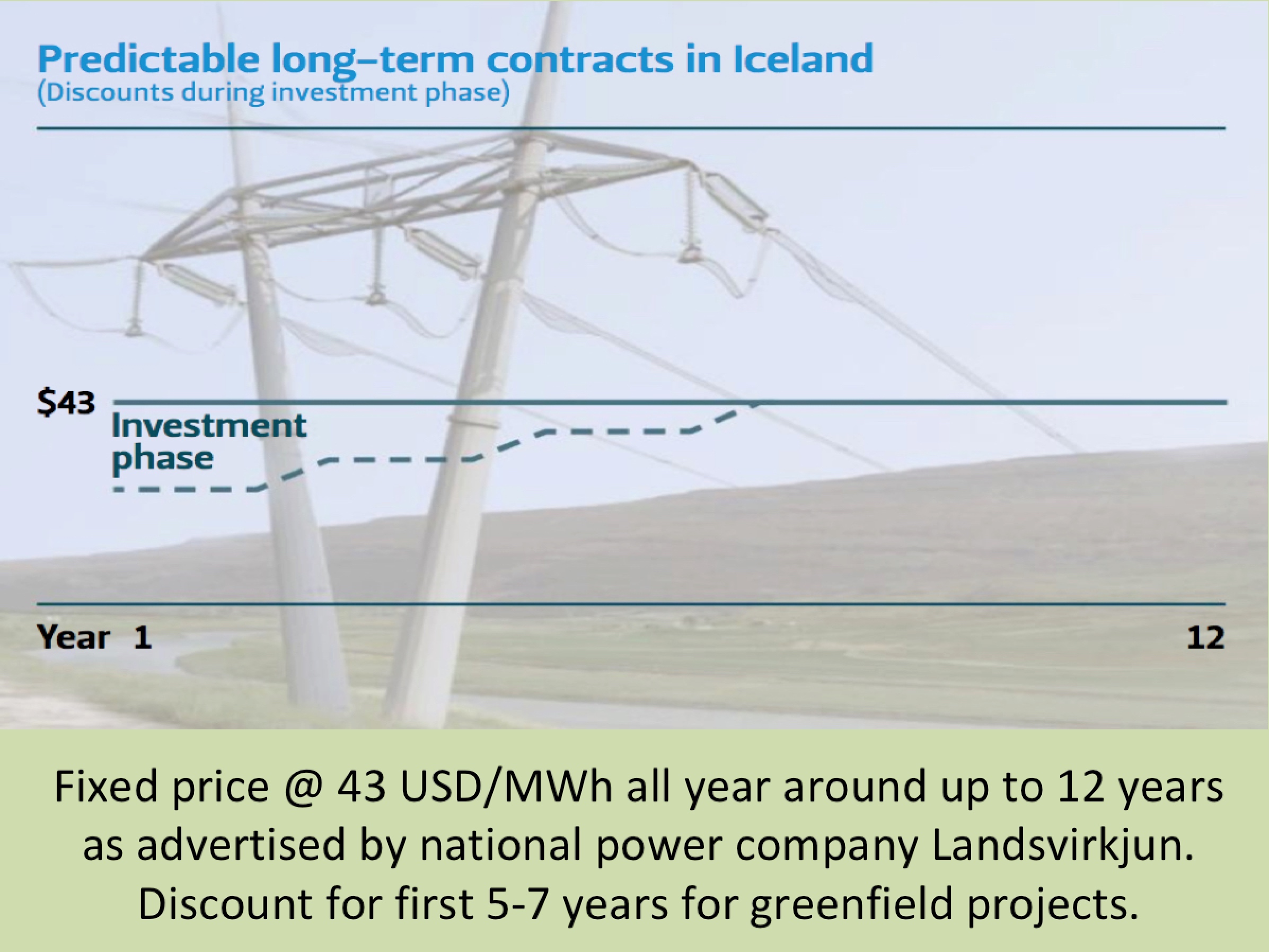

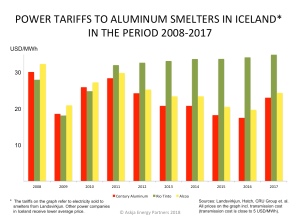

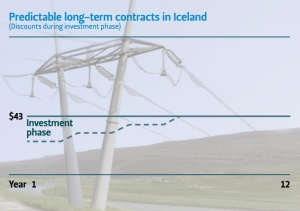

Landsvirkjun’s

Landsvirkjun’s