Data centers site selection

Which are the main decision drivers when companies are selecting location for data centers? This was the topic of an interesting presentation given Mr. Phil Schneider in Reykjavík earlier this summer. The event attracted high number of audience, which is not surprising as the date centre service in Iceland has great possibilities for strong growth.

Site selectors guild

Mr. Phil Schneider is the President of Schneider Consulting LLC and Chairman of the Site Selectors Guild. The Guild* is an association of the world’s leading site selection practitioners. Guild members provide location strategy to corporations across the globe and for every industry, sector and function.

Mr. Schneider divided his presentation into three main parts. Firstly, he discussed the most important general issues that dictates the choice of companies regarding location of their business units. Secondly, Mr. Schneider described how this relates to the location of data centers. And thirdly, he discussed the challenges facing Iceland in attracting more investment in data centers in Iceland.

Mr. Schneider divided his presentation into three main parts. Firstly, he discussed the most important general issues that dictates the choice of companies regarding location of their business units. Secondly, Mr. Schneider described how this relates to the location of data centers. And thirdly, he discussed the challenges facing Iceland in attracting more investment in data centers in Iceland.

Strong growth potentials for Iceland

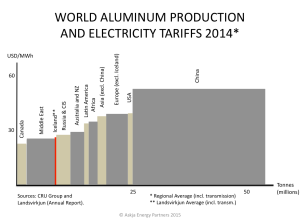

The data centre sector is growing rapidly all around the world. This trend creates interesting opportunities for Iceland in increasing diversity in the Icelandic economy. Due to extensive hydro- and geothermal resources, Iceland is able to offer more competitive long-term electricity contracts for data centers than available anywhere else in the western world (in addition, the Icelandic electricity is 100% green power).

This is an important incentive for locating data centers in Iceland. Furthermore, Iceland has highly qualified workforce for this sector and a competitive tax system. However, Iceland needs to consider its marketing strategy and must present the necessary information in a way that is easily accessible. clear, and understandable.

This is an important incentive for locating data centers in Iceland. Furthermore, Iceland has highly qualified workforce for this sector and a competitive tax system. However, Iceland needs to consider its marketing strategy and must present the necessary information in a way that is easily accessible. clear, and understandable.

Risk factors and misconceptions

Although site selection for data centers aims at being based on a thorough assessment of all the variables that may be relevant, it is quite common that misunderstanding regarding risk factors becomes a a major decision factor. According to Mr. Schneider, companies often jump to wrong conclusions regarding risk factors. In the case of Iceland, foreigners may for example have the perceived feeling that Icelandic is a risky location due to earthquakes or volcanic eruptions. In fact, natural risks are a less threat to business operations in Iceland than in for example most areas of the USA. In this context, it is tremendously important to present correct and accurate information to avoid wrong assumptions or mistaken image.

The Icelandic energy portal plays an important role

In his lecture Mr. Schneider emphasized the importance of good access to clear and reliable information about the Icelandic business environment and the energy sector. He especially referred to the Icelandic Energy Portal as such a source, regarding data center site selection. In the coming months we, at the Portal, are going to emphasize even stronger the issue of locating data centers and storing data in Iceland. Note that Mr. Schneider’s presentation can be watched here (starts at 36:22).

In his lecture Mr. Schneider emphasized the importance of good access to clear and reliable information about the Icelandic business environment and the energy sector. He especially referred to the Icelandic Energy Portal as such a source, regarding data center site selection. In the coming months we, at the Portal, are going to emphasize even stronger the issue of locating data centers and storing data in Iceland. Note that Mr. Schneider’s presentation can be watched here (starts at 36:22).

* Founded in 2010, the Site Selectors Guild is dedicated to advancing the profession of international corporate site selection by promoting integrity, objectivity, and professional development. Members are peer-nominated, vetted, and must demonstrate a significant amount of location advisory experience. Guild Membership is the highest standard in the site selection industry.