Following a tender in 2015, the Icelandic Ministry for Industries and Innovation signed Kvika bank and Pöyry to deliver advanced macroeconomic cost-benefit analysis of the impact of a subsea power cable between Iceland and Great Britain on Icelandic society. The report was published around mid-year 2016. The Icelandic title of the report is “Raforkusæstrengur milli Íslands og Bretlands, kostnaðar- og ábatagreining“, which in English would read as “Subsea electric cable between Iceland and Britain – cost-benefit analysis”.

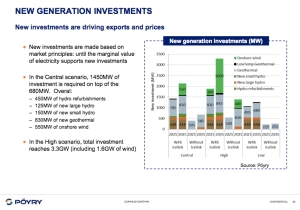

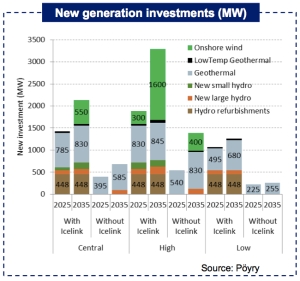

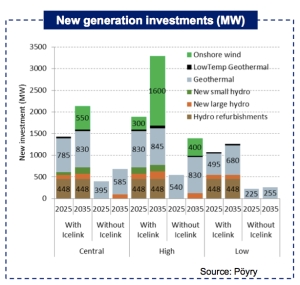

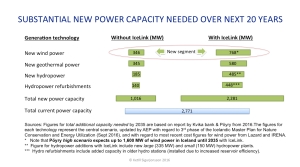

The key assumptions of the report are based on the following issues: Development of electricity demand in Iceland, the possibilities of new electricity generation in Iceland (including wind power), the cost of the project (including cost of the subsea interconnector, converter stations, new power capacity, and new transmission lines), cable-capacity and cable-uptime, cost of capital, development of electricity prices in the UK, and possible support from the British government. These issues include a.o. analysis on how much new hydro-, geothermal- and wind power capacity is expected to be constructed in Iceland until 2035.

The report by Kvika/Pöyry is highly interesting and includes extensive information which is very relevant to the project. However, it is obvious that its authors have made little effort in analyzing the possibilities of Icelandic wind power. This becomes evident when reading the part of the report that focuses on wind power (chapter 15.3.3). It is also noteworthy that the report makes absolutely no reference to the numerous recent university theses on Icelandic wind energy. And very limited direct references are made to the scientific paper “The wind energy potential of Iceland” by Nawri et.al., which so far is probably the main scientific examination on Icelandic wind potential.

The report by Kvika/Pöyry is highly interesting and includes extensive information which is very relevant to the project. However, it is obvious that its authors have made little effort in analyzing the possibilities of Icelandic wind power. This becomes evident when reading the part of the report that focuses on wind power (chapter 15.3.3). It is also noteworthy that the report makes absolutely no reference to the numerous recent university theses on Icelandic wind energy. And very limited direct references are made to the scientific paper “The wind energy potential of Iceland” by Nawri et.al., which so far is probably the main scientific examination on Icelandic wind potential.

The result is that the report by Kvika/Pöyry only offers a somewhat general introduction of wind energy utilization, without any real analysis on the potentials of harnessing wind for electricity generation in Iceland. The authors of the report simply make the general claim that wind power is still more costly than most planned hydro- and geothermal power projects in the utilization category of the Icelandic Master Plan for Nature Protection and Energy Utilization. This claim is not very well supported in the report. But the result is a conclusion by Kvika/Pöyry, that it is unlikely that any wind power will be harnessed in Iceland unless the IceLink HVDC subsea interconnector will be constructed.

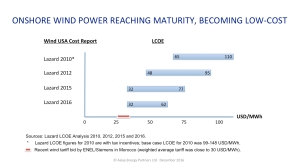

It should be noted that many of the power projects, described in the utilization category of the said Master Plan, have an expected LCOE between 40 and 50 USD/MWh (this especially applies to the geothermal projects). Having those cost figures in mind, it is interesting that high capacity wind locations outside Iceland offer as low LCOE as 32 USD/MWh (as explained by Lazard) and in rare cases even lower. When also having regard to other recent wind projects in high capacity areas, it seems clear that such projects offer LCOE that is lower than the expected cost of some of the planned geothermal projects in Iceland.

It should be noted that many of the power projects, described in the utilization category of the said Master Plan, have an expected LCOE between 40 and 50 USD/MWh (this especially applies to the geothermal projects). Having those cost figures in mind, it is interesting that high capacity wind locations outside Iceland offer as low LCOE as 32 USD/MWh (as explained by Lazard) and in rare cases even lower. When also having regard to other recent wind projects in high capacity areas, it seems clear that such projects offer LCOE that is lower than the expected cost of some of the planned geothermal projects in Iceland.

We could refer to several other recent wind power cost-analysis for the same outcome. As an example, Goldman Sachs expects onshore wind costs to fall into the range of 30-35 USD/MWh due to technology advancements. With this all is mind, it would have been both interesting and important if Kvika/Pöyry would have made further effort to analyze the potentials and cost of possible upcoming wind power projects in Iceland.

Of course it is also important to remember that extensive wind capacity may call for an increase in backup power. The extra cost due to such capacity additions may indeed make wind power more costly than explained by simple LCOE-analysis. However, the general assumption by Kvika/Pöyry, declaring Icelandic wind power in most cases more expensive than geothermal power in Iceland, seems somewhat hasty. The result may be an under-estimation of the potential of Icelandic wind power. And due to sensitivity of geothermal resources to over-exploitation, it is even possible that the expected fast-capacity growth of geothermal power in Iceland may in fact be an over-estimation.

—————————————–

The report by Kvika/Pöyry is officially only available in Icelandic. To give our readers a clear idea about how the report explains and analyses wind energy, we hereby publish an English translation of the part of the report that focuses on wind power (chapter 15.3.3). Note that the somewhat long sentences and un-precise references simply reflect how the Icelandic text is put forward in the report. And we express that all the following text is a translation of chapter 15.3.3 in the report, so the text does not reflect opinions of the Icelandic Energy Portal.

—————————————–

Chapter 15.3.3: Options for Onshore Wind Power in Iceland

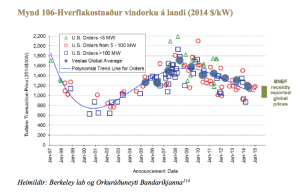

Wind is a well-known energy source. In recent years, technological development has made wind turbines more efficient and more stable. Also, the cost of constructing and operating onshore wind farms have decreased significantly in a short time, as seen on figure 106. Thus, wind power is closer to becoming competitive with other new energy projects in Iceland. Wind energy is increasingly harnessed worldwide. It is estimated that by 2020, the installed capacity of wind power in the world will be 1,000 GW, or as much as the hydropower in the world today.

[Fig. 106 – Cost of onshore turbines (2014 USD/kW). Sources: Berkeley lab and US Energy Ministry; US Energy Ministry Wind Technology Market Report 2014. Link to source.].

[Fig. 106 – Cost of onshore turbines (2014 USD/kW). Sources: Berkeley lab and US Energy Ministry; US Energy Ministry Wind Technology Market Report 2014. Link to source.].

Given the limited environmental impact of wind power compared to prolonged or permanent impact of hydropower, wind power should be considered as an important option for renewable energy production, especially in a country like Iceland, which has great wind power potential and is sparsely populated. [Ref. 215: Icelandic Meteorological Office, Wind energy potentials in Iceland 2013].

Windmills need to be connected to the grid, which preferably should be close to the location of the windmill. It also makes sense to take population density and tourism into account when deciding where to locate windmills, as many feel they spoil the beauty of the landscape in which they stand. All in all, numerous factors need to be taken into account when deciding where to locate windmills. [Ref 216: Wind energy as option in Iceland 2012, Environmental considerations, James Dannyell Maddisson and Rannvá Danielsen].

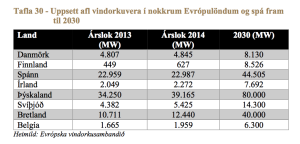

In 2014, Europe had 12,820 MW of installed wind power capacity. [Ref 217: Wind energy in Energy statistics 2014 and wind energy scenarios for the year 2030, European Wind Energy Association 2015]. Table no. 30 shows the installed wind power in selected European countries by end of 2014 and forecast for 2030. [Table 30 – Installed wind energy capacity in some European countries and forecast for 2030. Source: European Wind Energy Association].

In 2014, Europe had 12,820 MW of installed wind power capacity. [Ref 217: Wind energy in Energy statistics 2014 and wind energy scenarios for the year 2030, European Wind Energy Association 2015]. Table no. 30 shows the installed wind power in selected European countries by end of 2014 and forecast for 2030. [Table 30 – Installed wind energy capacity in some European countries and forecast for 2030. Source: European Wind Energy Association].

By end of 2014, installed onshore wind power capacity in Iceland was only 3 MW. Landsvirkjun [the national power company] has presented plans for two onshore wind farms to be evaluated in the third phase of the Master Plan [Icelandic Master Plan for Nature Protection and Energy Utilization]; one wind farm with an installed capacity of 200 MW delivering up to 705 GWh/year and the other 100 MW delivering up to 350 GWh/year, a total of 300 MW and more than 1 TWh/year. Private parties, both domestic and foreign, have also been exploring the possibility of building and operating onshore wind farms in Iceland.

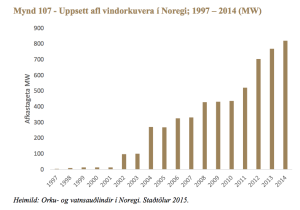

By end of 2014, Norway had constructed wind parks with an installed capacity of 856 MW, delivering an average of 2.2 TWh of electricity annually, with 31% capacity factor [ref 218: Governing department of water resources and energy matters in Norway, NVE], which constitutes to 1.2% of the country’s electricity generation. See Figure 107 – Installed capacity of wind power in Norway.

[Fig. 107 – Installed capacity of wind power stations in Norway; 1997-2014 (MW)].

[Fig. 107 – Installed capacity of wind power stations in Norway; 1997-2014 (MW)].

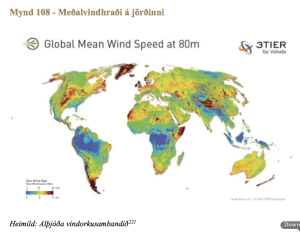

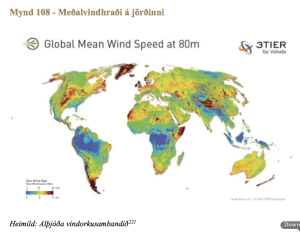

The development of wind power in Norway has so far not been economical without subsidies and the wind farms that have been constructed have been subject to subsidies. Yet, Norway has in general good wind resources, compared to other countries. By the start of 2014, new wind power projects with a generation of about 9.1 TWh/year had been authorized in the country. However, it is unclear whether all this power will be developed. The possibility, however, exists if market conditions supports the investment, all the necessary planning has been completed, and permits have been given. [Ref 219: Figures from 2015, Energy- and water resources in Norway, Norwegian Oil and Energy Ministry]. Iceland is very well suited for electricity generation by onshore wind, as shown in Figure 108, which shows the average wind speed at 80 m height .

[Fig. 108 – Average wind speed on Earth. Source: World Wind Energy Association. Global evaluation on wind resources. December 2014. Link to source].

[Fig. 108 – Average wind speed on Earth. Source: World Wind Energy Association. Global evaluation on wind resources. December 2014. Link to source].

Wind measurements give very good results and a limiting factor for the development of wind energy in Iceland will not be lack of wind, but political and environmental concern, proximity to other industries and services, power transmission and wholesale prices of electricity. In our simulation, the cost of onshore wind power is set higher than most other options and thus large-scale wind power development is not expected unless domestic demand will grow much or a subsea cable will be laid. This may change if the cost of new onshore wind power plants continues to decline. Thus, onshore wind energy could become a more economical option than geothermal power plants in the near future.

The question that remains, is if and when the decision will be taken on IceLink. But even without IceLink, it is likely that new wind power will be developed in Iceland in the coming years, as numerous locations in Iceland offer very high capacity factor for wind turbines.

The question that remains, is if and when the decision will be taken on IceLink. But even without IceLink, it is likely that new wind power will be developed in Iceland in the coming years, as numerous locations in Iceland offer very high capacity factor for wind turbines.