Icelandic wind power becoming highly interesting

So far, less than a handful of modern wind turbines have been constructed in Iceland. It has simply been more economical to harness geothermal- and hydro resources for power generation. This situation may be changing, as it is becoming economically interesting to harness Icelandic wind energy. In this article we take a look at some hydropower projects that are currently being considered in Iceland, comparing them to the cost of utilising wind energy. It turns out that harnessing the Icelandic wind may indeed becoming a very interesting investment.

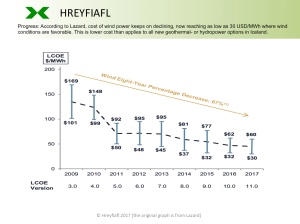

Astonishing cost decline of wind power

It has been called “the fastest and most astonishing turnarounds in the history of energy“: In some areas, building and running new renewable energy has become cheaper than just running existing coal and nuclear plants.

As Iceland is or at least has been quite special, by generating all its electricity through harnessing fairly low-cost geothermal- and hydropower sources, one might wonder if the declining cost of wind and solar will have any consequences for the Icelandic power sector? The answer is not very complicated. Due to Iceland’s northerly location, solar power is not becoming a real competitive option in generating electricity in Iceland. On the other hand, Iceland offers numerous locations with very high wind capacity factor. Thus, the declining cost in the wind power industry may soon drive important changes in the Icelandic power sector, where wind farms will become a lucrative business.

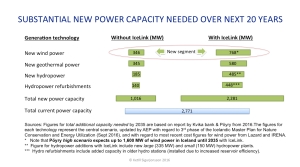

Several small [expensive] hydropower plants being prepared

Several small hydroelectric projects (with a capacity below 10 MW) are currently being prepared in Iceland. These include 9.9 MW Brúará hydropower station in South Iceland, 9.8 MW Svartá hydropower station in Northern Iceland, 9.3 MW hydroelectric plant in glacial river Hverfsfljóti in Southwest Iceland, and 5.5 MW Hólsvirkjun hydropower station in Northern Iceland. The combined capacity of these four stations would be close to 35 MW. With an estimated cost well above 3 million USD pr. each megawatt, all those projects will be quite costly and probably more costly than harnessing Icelandic wind energy.

Somewhat larger project is the 55 MW Hvalá River hydropower station, to be constructed in the faraway Northwestern part of Iceland (Vestfirðir or West Fjords). This power plant will be quite costly and the transmission cost will be high, as the project is far away from the current transmission system. However, due to the high reliability of the Hvalá station with its mountain reservoirs, the project can be seen as quite sensible. On the other hand, wind farms may also offer quite strong reliability, such as if constructing three 30-40 MW of wind power in different locations in or close to the West Fjords. By locating the wind farms adjacent or close to the current transmission lines, such a project might be less costly than the somewhat expensive Hvalá hydroelectric station with its high transmission cost.

Somewhat larger project is the 55 MW Hvalá River hydropower station, to be constructed in the faraway Northwestern part of Iceland (Vestfirðir or West Fjords). This power plant will be quite costly and the transmission cost will be high, as the project is far away from the current transmission system. However, due to the high reliability of the Hvalá station with its mountain reservoirs, the project can be seen as quite sensible. On the other hand, wind farms may also offer quite strong reliability, such as if constructing three 30-40 MW of wind power in different locations in or close to the West Fjords. By locating the wind farms adjacent or close to the current transmission lines, such a project might be less costly than the somewhat expensive Hvalá hydroelectric station with its high transmission cost.

Icelandic wind power becoming competitive

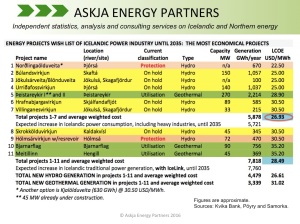

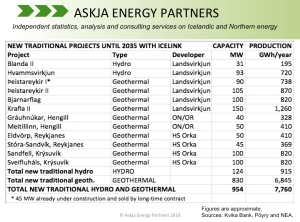

According to a recent study published by the federation of energy and utility companies in Iceland (Samorka), the levelized cost of energy (LCOE) for upcoming Hvalá River hydropower station is expected to be 49.70 USD/MWh (and then the transmission cost is not included). In comparison, in its most recent “levelized cost of energy analysis” (LCOE), financial advisory and asset management firm Lazard now estimates the LCOE for wind farms in good locations in the USA as low as 30 USD/MWh (as explained on the slide at top of the article).

It is also interesting that according to a new study by the universities IIT Comillas in Madrid and MIT in Boston, wind farms in Iceland could generate electricity at LCOE close to or even below 35 USD/MWh. This low cost beats all planned geothermal projects in Iceland and is lower cost than most of the hydropower projects under consideration, making the development of wind farms in Iceland highly interesting.

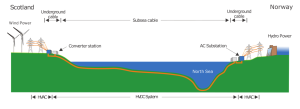

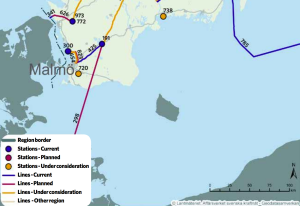

However, it is still interesting to invest in new geothermal- and hydropower plants in Iceland, as they in general offer very reliable power production. Iceland is an isolated power market with no interconnectors to other countries, and thus the country has to rely on domestic access to spare capacity when the wind would not be blowing well enough.

For wind farms to be competitive in Iceland, they need to be cheap enough to make it an interesting option to increasing the output from the robust system of the Icelandic hydro reservoirs (such process of adding new turbines to conventional hydropower stations has already started in Iceland). By such methodology it will be possible to add substantial capacity in the power system without constructing expensive new hydropower reservoirs or geothermal stations. Also, low-cost Icelandic wind power could be harnessed to save water in the current reservoirs, and/or work as pumped hydroelectric storage. Due to such interesting possibilities, it is likely that wind farms will soon be constructed in Iceland even without any connection with foreign power markets. Of course an interconnector like IceLink would make Icelandic wind power even more interesting to harness.

One wind farm instead of four hydroelectric plants?

Earlier we mentioned the four fairly small hydroelectric projects (each below 10 MW) currently being prepared in Iceland. When comparing how much wind power would be needed to offer equal generation as the four hydropower stations, it seems quite clear that harnessing the Icelandic wind would be less costly and have less negative environmental impacts.

The total power capacity of the said four hydropower stations (Brúará, Svartá, Hverfisfljót and Hólsvirkjun) will/would amount to approximately 35 MW. Some of them would have the advantage of offering quite stable generation all year around, while a project like the 9.3 MW Hverfisfljót hydropower station would be harnessing glacial water where the flow in winter is very low. This means that the yearly capacity-factor of the Hverfisfljót station will probably be quite low; even under 50%.

Of course a wind farm would deliver more fluctuating production than the combined four hydropower stations, thus needing more backup power. And in the long run, hydropower is probably almost always the lowest cost option (due to very long life time), at least if the environmental damage by dams and head-race canals of the hydro projects are not taken into account.

It is not simple to estimate how much Icelandic wind power would be needed to generate a similar amount of electricity as the four hydropower stations. Probably a well-located Icelandic wind farm(s) with a capacity of approximately 70-80 MW could generate as much electricity annually as the four hydropower stations of totally 35 MW. The cost of the hydroelectric stations would most likely be close to USD 120 million. The cost of 70-80 MW wind farm in Iceland could be substantially lower; probably below USD 100 million.

When also having regard to the environmental impact, the option of wind power in Iceland becomes even more attractive. Besides the wind farm(s) of 70-80 MW being less costly than the four hydropower stations of 35 MW, the wind farm offers the chance of avoiding severe environmental damages to some of Iceland’s wild and free running rivers. For example in the case of the Hverfisfljót hydropower project, the waterfalls in the river-canyon would become close to dry substantial part of the year. However, the key issue for harnessing Icelandic wind power is the declining cost in wind energy technology. Which now is making wind power a real option in the Icelandic energy sector.

NB: Icelandic wind power development firm Hreyfiafl has same ownership as Askja Energy Partners. Hreyfiafl aims to have its first wind farm in Iceland in operation within five years from now. Icelanders can follow the process through the Twitter-account of Hreyfiafl.