Iceland is a highly attractive place to locate a data centre and is positioned to become an international data centre hub, according to an independent study conducted by BroadGroup Consulting. On the key issue of power, encompassing everything from costs to quality to regulation, Iceland scores higher than leading global data centre locations, such as the USA, UK, Sweden, Singapore and Hong Kong. When all the issues are taken together, Iceland has truly become an extremely attractive location in which to site a data centre. Reasons include:

Iceland is a highly attractive place to locate a data centre and is positioned to become an international data centre hub, according to an independent study conducted by BroadGroup Consulting. On the key issue of power, encompassing everything from costs to quality to regulation, Iceland scores higher than leading global data centre locations, such as the USA, UK, Sweden, Singapore and Hong Kong. When all the issues are taken together, Iceland has truly become an extremely attractive location in which to site a data centre. Reasons include:

1. All the basic factors in place

The reality for most data centre users is that they need all basic issues to be in place. This includes cheap energy and strong connectivity, and also areas as telecoms, power, reliability, taxation and business environment, and the legal/regulatory framework. According to BroadGroup, Iceland has these factors in place.

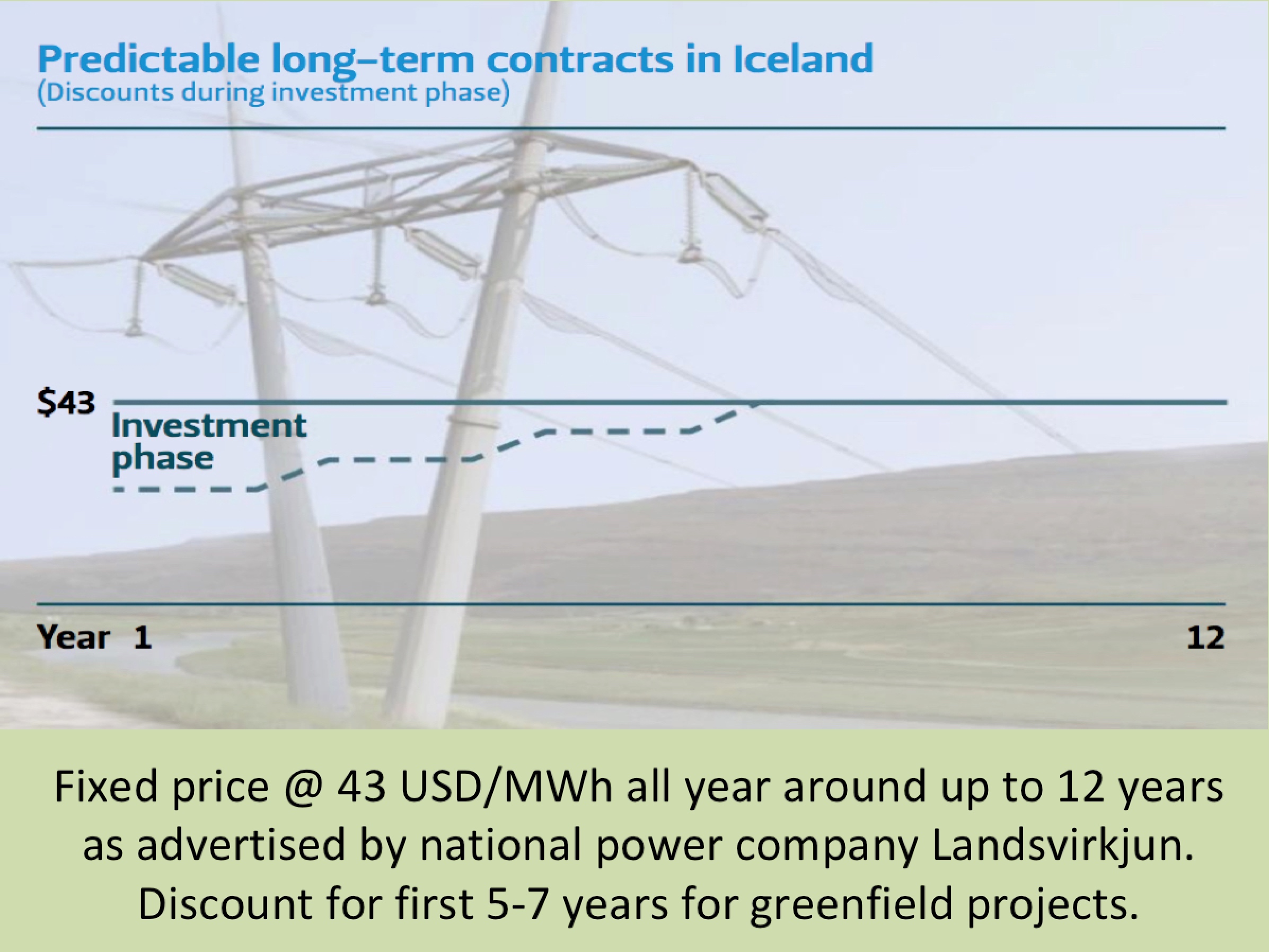

2. Low-cost power

Iceland is also highly attractive in terms of differentiating factors such as power costs and availability, government support and incentives, and operating costs. Power is the biggest operating cost item for data centre users. Iceland is highly competitive on power pricing today, and can provide commitments for ten years or potentially more. Iceland power costs can be halve those in Scandinavia, and significantly more competitive than other European countries. Iceland’s power costs remain very likely to stay much lower than other countries, particularly given the opportunity to cap such prices for ten years or even longer for greenfield projects. Factoring in all data centre cost factors over a ten year period, shows the significant savings available in choosing Iceland (as per chart).

3. Excellent reliability

Power reliability and quality are extremely high. Iceland has a long history with a key group of power-intensive users already (such as the aluminum smelters). Such users, including global leaders such as Rio Tinto and Alcoa, can have requirements of >400MW and have expanded their sites in Iceland due to the strong reliability and availability. These are users for whom an outage of more than an hour would cause serious damage, and have selected Iceland and expanded in Iceland due to its power reliability. For these businesses, there have no disruptions due to natural disasters since the first smelter started operating in Iceland in over 40 years ago.

4. Base-load renewable energy

Icelandic power is 100% green. Iceland is one of few countries in Western Europe with large quantities of competitively priced, renewable carbon neutral electricity. Setting Iceland apart from most countries, it produces electricity using exclusively hydropower, geothermal energy and onshore wind. These are sustainable, environmentally “green” resources with zero carbon trade-offs. This makes it an ideal location for addressing corporate responsibility considerations.

5. Good connections

On telecoms, existing connectivity, Greenland Connect, FARICE and DANICE are being substantially upgraded, while significant new capacity is planned to be added over the next several years, enabling up to 30 Tbit/s of full capacity. In terms of telecoms pricing, large international users are able to negotiate prices which are comparable with transatlantic prices into mainland Europe. For example, Icelandic prices are close to the Telegeography Median 10G transatlantic prices reported in Q4 2012. The telecoms pricing attractiveness is illustrated by existing users in Iceland, such as Opera Software, which uses >50 Gbit/s of capacity. Furthermore, Iceland is ideally situated between the US and Europe, and is highly accessible with 20+ airlines landing on the island. Many of the Iceland data centers are also within a short drive of Reykjavik airport.

On telecoms, existing connectivity, Greenland Connect, FARICE and DANICE are being substantially upgraded, while significant new capacity is planned to be added over the next several years, enabling up to 30 Tbit/s of full capacity. In terms of telecoms pricing, large international users are able to negotiate prices which are comparable with transatlantic prices into mainland Europe. For example, Icelandic prices are close to the Telegeography Median 10G transatlantic prices reported in Q4 2012. The telecoms pricing attractiveness is illustrated by existing users in Iceland, such as Opera Software, which uses >50 Gbit/s of capacity. Furthermore, Iceland is ideally situated between the US and Europe, and is highly accessible with 20+ airlines landing on the island. Many of the Iceland data centers are also within a short drive of Reykjavik airport.

6. High educational skills and modern European business environment

There is a high education level in Iceland and strong availability of highly skilled technical staff. A major issue for data centre users is how a location will evolve over the 15+ years of the facility. Some of the large, existing data centre locations are facing key challenges such as lack of land, power availability and the threat from natural disasters. By contrast, Iceland is rapidly developing as a global data centre location, with a highly committed, stable and democratic government and clear focus on the sector, and a legal system in line with the European Union..

7. Positive political support

The Icelandic economy is strongly supportive of IT investment, and has particularly looked to ensure it is attractive to those looking to site data centers in the country. This has attracted an impressive range of global companies who already have data centers in the country, including Opera Software, COLT Telecom, BMW, Datapipe and the Joint Nordic Supercomputer. It has also attracted data centre outsourcing companies such as Advania and Verne Global. The Iceland government has also developed specific incentives for the industry.

8. Low natural risk

Iceland does have earthquakes, but most are tiny (<2 on Richter scale). They also tend to be well away from the best data centre sites, and the electricity production and distribution infrastructure has been developed in such a way that it is not vulnerable to earthquakes or strong winds. Indeed, earthquakes and volcanic eruptions of the last decades have caused no real damage and had no disrupting effect on the services of electric power transmission, power production or telecommunication in the country as a whole and no effect on local services for the potential sites. A detailed independent study has shown that estimated risk from earthquakes and volcanoes is still relatively low, especially compared with places like California. Indeed, even New York State had 400 earthquakes with Richter magnitude greater than 2.0 recorded between 1700 and 1986. Iceland also has negligible risks from other natural disasters such as hurricanes, heat waves, droughts, wildfires and tsunamis.

9. Plenty of space available

Iceland also offers two of the other key requirements of many data centre users – space and flexibility. There is plenty of space to build data centers of different designs, rather than being forced to use refurbished buildings or multi-storey sites. For example, land is available at suitable locations close to both the capital Reykjavik and the Keflavik International Airport. And there is flexibility to provide different solutions, from high-connectivity, purpose-built technology parks to sites that are close to energy sources and offer a green and low-cost option.

BMW is using the campus of Verne Global for crash simulations, aerodynamic calculations and other computer-aided design (CAD) purposes. This requires plenty of electricity, both for the transactions and to keep the infrastructure cool. By moving ten of its high-performance computing clusters (HPC) to Iceland from Germany, BMW hopes to reduce annual carbon emissions by 3,570 metric tons.

BMW is using the campus of Verne Global for crash simulations, aerodynamic calculations and other computer-aided design (CAD) purposes. This requires plenty of electricity, both for the transactions and to keep the infrastructure cool. By moving ten of its high-performance computing clusters (HPC) to Iceland from Germany, BMW hopes to reduce annual carbon emissions by 3,570 metric tons.