Earlier this month, Mr. Ola Borten Moe, former energy- and petroleum minister of Norway, was in Iceland, discussing the development of the Norwegian electricity market.

In a presentation, at the Harpa Conference Hall in Reykjavík, Mr. Borten Moe gave a comprehensive insight on the matter. This open meeting took place on September 9th (2014) and was hosted by VÍB. The meeting was very well attended; in addition to the crowd at the hall at Harpa close to two thousand people watched the event live on the web (where a video recording is now available).

After the keynote speach by Mr. Borten Moe, there were panel discussion with three more participants; Ms. Ragnheiður Elín Árnadóttir, Icelandic Minister for Energy and Industries, Mr. Hörður Arnarson, CEO of Landsvirkjun Power Company, and Mr. Ketill Sigurjónsson, Managing Director of Askja Energy Partners. In his presentation Mr Borten Moe especially focused on two main issues; .Norway’s experience from the liberalization of the electricity market and Norway’s experience from the interconnectors (electric HVDC cables) between Norway and outher countries. Here we will highligt some parts of Mr. Borten Moe’s presentation. For reference, we will quote a transcript from the meeting, now accessible at the website of Landsvirkjun.

After the keynote speach by Mr. Borten Moe, there were panel discussion with three more participants; Ms. Ragnheiður Elín Árnadóttir, Icelandic Minister for Energy and Industries, Mr. Hörður Arnarson, CEO of Landsvirkjun Power Company, and Mr. Ketill Sigurjónsson, Managing Director of Askja Energy Partners. In his presentation Mr Borten Moe especially focused on two main issues; .Norway’s experience from the liberalization of the electricity market and Norway’s experience from the interconnectors (electric HVDC cables) between Norway and outher countries. Here we will highligt some parts of Mr. Borten Moe’s presentation. For reference, we will quote a transcript from the meeting, now accessible at the website of Landsvirkjun.

Positive economic and environmental effects

Mr. Borten Moe explained how the Norwegian deregulation of the elctricity market, which happened in the 1990’s, became a model for similar changes in Europe a decade later. He also described how interconnectors (electric cables) between Norway and other countries have benefitted both the Norwegian people and the domestic energy industry in Norway.

According to Mr. Borten Moe, the market deregulation and the interconnectors have been very positve for the Norwegian society. It has lead to more efficiency in the Norwegian hydropower industry, wich is mostly in public ownership. Also Mr. Borten Moe stated, that the interconnectors have resulted in a better access to electricity supply, which has especially been important for Norway in dry periods (as Norway’s electricity generation is almost 100% based on hydropower). Even more, the result of the more competitive electricity market has not only been the financial benefit, but also a better stewardship of the natural resources. In Borten Moe’s own words:

“We [Norwegians] experienced a huge efficiency gain in the power production industry. And not did they only turn around all the heads in all of the industry, but […] also turned around the head to everyone owning the industry. Meaning that thousands of people could be liberated or do something else and more productive for society.”

“We [Norwegians] experienced a huge efficiency gain in the power production industry. And not did they only turn around all the heads in all of the industry, but […] also turned around the head to everyone owning the industry. Meaning that thousands of people could be liberated or do something else and more productive for society.”

“From the mid-1990s and outwards, the [electricity generating] industry produced huge surpluses, and these are values that are put back into work for the Norwegian society through the fact that there are municipalities, counties, and the government owning it. So we build roads, we build schools, we build health care systems for the values created in our power industry.”

“I foresee Norway being willing to take a bigger place when it comes to capacity regulating systems, using our hydropower system more to regulate for necessary regulations of the European power markets being more dependent on renewables […] and also maybe even selling electricity, being a net exporter. That is basically what we do with oil and gas.“

“So far in Norway, this has been the story that I told you. It has been more well functioned markets, increased efficiency, more values created, more security of supply and now lower electricity prices because we have introduced more production capacity into the market.”

Efficiency in the electricity industry serves as natural protection

The Norwegian electricity market was tightly regulated up until the 1990’s. This meant very limited competition. Low returns were a normal condition in the electricity production and this lead to over-investment in the hydropower sector. One of the effects of the deregulation was more access to economical supply outside of the former small highly regulated markets in Norway. Thus, the deregulation served as an incentive to not utilize some of the less economic hydropower sources. Or as Mr. Borten Moe explained:

“[My] predecessor, Eivind Reiten, who is the father of the new energy system, when he presented the new energy bill to Parliament in 1990, deregulating the whole sector as one of the first countries in the world, he said that this bill would save more Norwegian nature and water and waterfalls than any gang in chains would ever do. And he was right. So the deregulation and the market system in Norway has also been one of the biggest reforms to save Norwegian nature.”

“[My] predecessor, Eivind Reiten, who is the father of the new energy system, when he presented the new energy bill to Parliament in 1990, deregulating the whole sector as one of the first countries in the world, he said that this bill would save more Norwegian nature and water and waterfalls than any gang in chains would ever do. And he was right. So the deregulation and the market system in Norway has also been one of the biggest reforms to save Norwegian nature.”

“Norwegians strongly believe that access to electricity should be cheap, it should be unlimited, and it should be safe. And it should not disturb the nature, which basically means that you have a lot of wishes and demands and it’s not always very easy to fulfill all those wishes at once.”

“I think it is a fact that you need to consume nature to produce electricity and power but basically I would say that if you are to do it at least you need to produce a lot of money, a lot of values for society doing it.”

Competitiveness of Norwegian industries is still strong

The deregulation of the Norwegian electricity market and increased interconnectors have had fairly limited impact on industries in Norway; even energy-intensive industries. Electricity prices have indeed risen, but the competitiveness of the industry relies much more on the global market conditions rather than the electricity price in Norway.

The interconnectors and increased efficiency in the Norwegian electricity sector has been a success in increasing profits in the industry. One of the results is increased tax-revenues. This has created more possibilities for the Norwegian government to set up incentive schemes to positively increase investment of industries in Norway. When valuating the financial effects of the deregulation and more interconnected electricity market, the wholistic economic result in Norway has been very positive. As Mr. Borten Moe explained:

The interconnectors and increased efficiency in the Norwegian electricity sector has been a success in increasing profits in the industry. One of the results is increased tax-revenues. This has created more possibilities for the Norwegian government to set up incentive schemes to positively increase investment of industries in Norway. When valuating the financial effects of the deregulation and more interconnected electricity market, the wholistic economic result in Norway has been very positive. As Mr. Borten Moe explained:

“What we have seen when it comes to our industries during the last 25 years, both through the deregulation and now with the more Nordic and European electricity market, is not that they have fled the country.”

“The world markets are far more important for the development of our power intensive industries than the electricity prices, and the electricity prices have not gone all that much up.”

“We see a new interest in reinvesting in Norway, Norwegian power intensive industries. Norwegian, our Norsk Hydro, which is our huge aluminum smelter company, is probably going to build a huge new smelter up in Karmøy [in Southwestern Norway].“

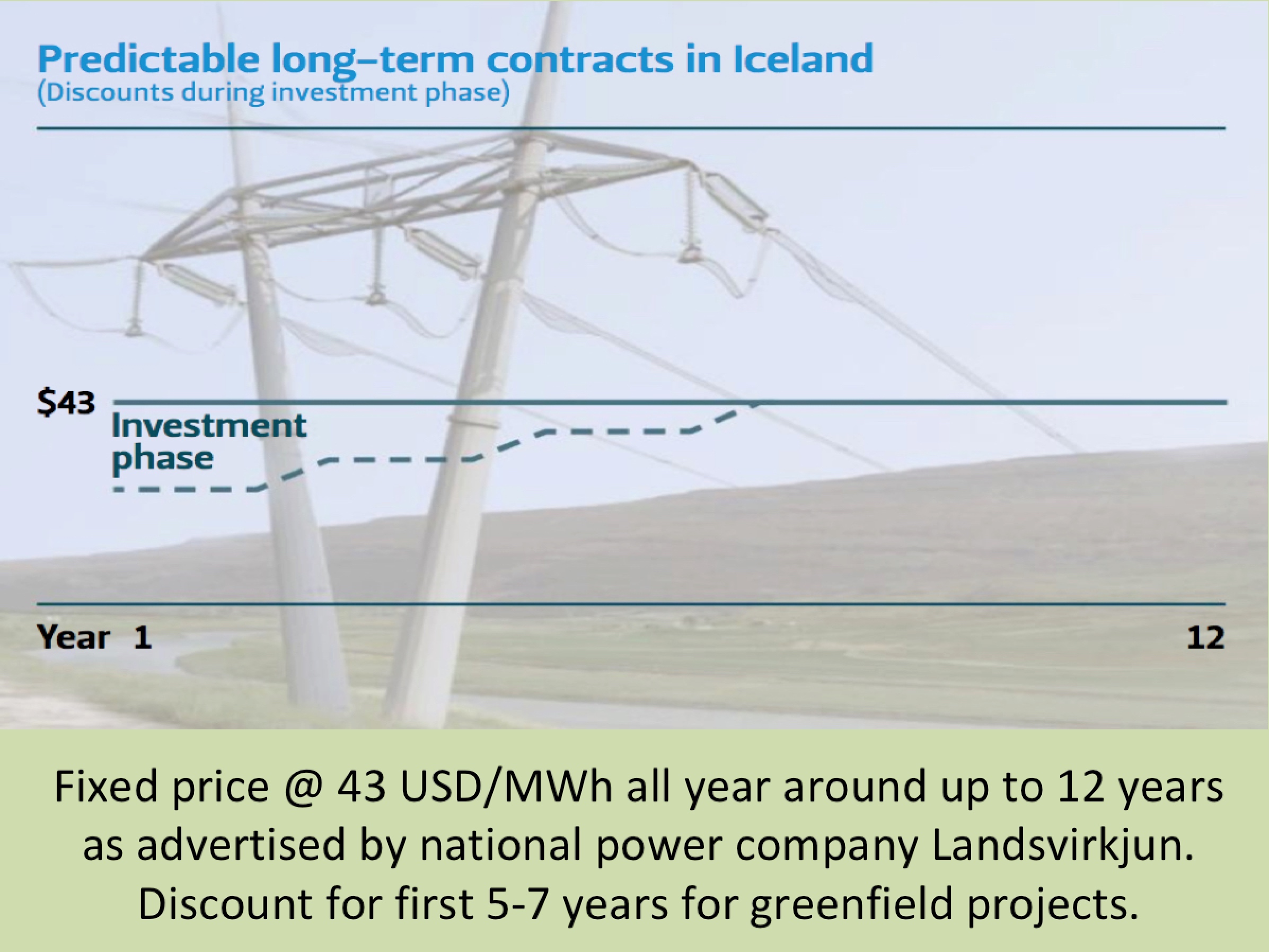

“And it is also a fact that in Norway, the power companies, the production companies, when they negotiate long term contracts, they know that they need the power intensive industries, after all, it’s their biggest clients. They use around 40 out of 120 terawatt hours, and if they go away, you would completely take the floor out of the Norwegian electricity market and the prices of the whole portfolio would go to the bottom. And they would lose a lot of money.“

“And it is also a fact that in Norway, the power companies, the production companies, when they negotiate long term contracts, they know that they need the power intensive industries, after all, it’s their biggest clients. They use around 40 out of 120 terawatt hours, and if they go away, you would completely take the floor out of the Norwegian electricity market and the prices of the whole portfolio would go to the bottom. And they would lose a lot of money.“

“In Norway at least, I am convinced that we are not going to produce aluminum because we have cheaper prices than anywhere in the world or because we have lower regulations on the environment. On the contrary I think that we should have good prices on energy, meaning also [the aluminum smelters] should pay enough for the energy to make them wish every day they wake up to get a little better and a little bit more efficient and a little bit more competitive and it should be the same when it comes to environmental regulations.“

Stable and secure energy supply

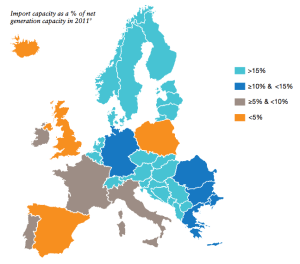

According to Mr. Borten Moe, increased interconnection has contributed to strengthening the electricity supply for Norwegian consumers. Norway’s electricity production is close to 100% based on hydropower. In dry periods, less water in rivers and reservoirs can result in temporarily very high electricity prices and even problems in supplying enough electricity to meet the demand. The possibility of importing electricity through subsea cables and other interconnectors, makes it much easier for the generating industry to offer stable and secure supply of electricity.

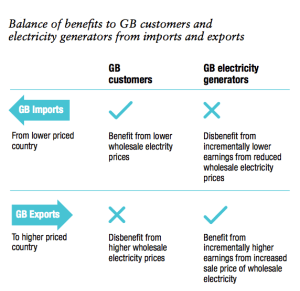

The interconnectors also offer the possibility to export electricity when prices at the other end of the cable (such as in the Netherlands) are high. This means that interconnectors improve yield and profitability of the utilization of hydropower resources in Norway.

The interconnectors also offer the possibility to export electricity when prices at the other end of the cable (such as in the Netherlands) are high. This means that interconnectors improve yield and profitability of the utilization of hydropower resources in Norway.

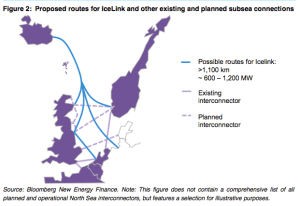

With this in mind, it is interesting that on average approx. 10% of the water in the Icelandic hydro reservoirs flows through spillways. If Iceland would be connected with another electricity market (preferably fairly large market, such as the British or German markets) it could be very economic and efficient to add more turbines and utilize the spillwater to generate electricity and sell it through such a subsea cable (interconnector). With regard to this, it is interesting to consider Norway’s experience as described by Mr. Mr. Borten Moe:

“In 2003, I think we had a summation, a mind gobbling situation, because the prices of electricity peaked, and the population asked serious questions about is Norway really able to secure the amount of energy that we need when we need it, and at a price that is affordable. At that time, I would say that this was a fair question. And if you look at […] 2002, 2003 in this form, you’d also see that production was fairly low and that it was a combination of little rain, low temperature, and lack of import capacity that brought us into this situation.“

“In 99% of the cases we manage to get the electricity out on the market, use more of it but as you said, if we had been an island, well then we, the electricity that we [sold to] Sweden, Denmark, Finland, Russia, the Netherlands would have been water going over the dams.”

“In 99% of the cases we manage to get the electricity out on the market, use more of it but as you said, if we had been an island, well then we, the electricity that we [sold to] Sweden, Denmark, Finland, Russia, the Netherlands would have been water going over the dams.”

“The question of interconnectors in Norway is not only a question about selling electricity, or selling energy. It’s also a question about buying electricity, and it is a question about security of supply, even when the weather is dry and the weather is cold.“

Modest electricity prices for Norwegian households

In his presentation, Mr. Ola Borten Moe stated that despite increased interconnection of electricity markets the electricity price in Norway is generally less than for example on the European mainland. In the opinion of Borten Moe, the impact the interconnectiors have on the electricity price is limited in comparison with the effects of the relative supply and demand within each of the connected electricity markets. As Norway is currently increasing domestic investment in electricity generation, Mr. Borten Moe expects price reductions. In addition, Norwegians have used the revenue from the international connections to lower the electricity bill of Norwegian consumers.

“It is basically the balance in the market, or the lack of balance in the market, that is the most important factor for price. If we have good security of supply, a good balance in market, and slightly more production and consumption, prices will be fairly low.“

“It is basically the balance in the market, or the lack of balance in the market, that is the most important factor for price. If we have good security of supply, a good balance in market, and slightly more production and consumption, prices will be fairly low.“

“In Norway we are interconnected, but not a part of a perfect market with the European electricity markets. There are still differences in price, between our price and the European price, and it will probably continue to be so.”

“The surplus from these interconnectors goes to lowering the electricity bills to all Norwegian consumers, including industry. So as long as they produce a surplus, it’s a direct benefit to the Norwegian household and the Norwegian industry.“

Issues to consider

The conclusion is that Norway’s experience from the increased interconnection of electricity markets has been positive. Mr. Ola Borten Moe stated that despite this fact, there are nonetheless several issues that Iceland must consider before it is possible to decide on the possible construction of a subsea cable between Iceland and Europe.

Borten Moe expressed that the Norwegians emphasize the importance of utilizing their infrastructure in a sound economical manner and that further disturbance of the environment must be based on guaranteed profitability. He also mentioned that although subsea electric cables would generally have the effect that electricity prices at the markets at each ends of the cable have the tendency to be similar, at least to some extent, nevertheless it is the supply and demand in each market that is dominating in deciding the prices in each of the markets. As Borten Moe said:

Borten Moe expressed that the Norwegians emphasize the importance of utilizing their infrastructure in a sound economical manner and that further disturbance of the environment must be based on guaranteed profitability. He also mentioned that although subsea electric cables would generally have the effect that electricity prices at the markets at each ends of the cable have the tendency to be similar, at least to some extent, nevertheless it is the supply and demand in each market that is dominating in deciding the prices in each of the markets. As Borten Moe said:

“We like to have control over this kind of infrastructure, we need to know how much goes in, how much goes out. We need to keep control about how the values flow and who gets the benefits.“

“It is possible to foresee a future when we use subsidies to get new electricity into the market, taxpayers’ money, new production capacity, and we sell this production capacity with a loss to the European markets and we lose both money and Norwegian nature. And that, of course, would be a whole different story.”

“If you have two markets and you make an interconnector, you will basically have a price that are more of the same. That’s the law of nature and the whole ratio for building such an interconnector. But it’s also fair to say that it’s also a question of what kind of capacity you introduce. In a perfect market, you would have the same price, but these are not perfect markets.”

KPMG International’s ‘Infrastructure 100: World Markets Report highlights key trends driving infrastructure investment around the world. In the report, a global panel of industry experts identifies 100 of the world’s most innovative, impactful infrastructure projects. Furthermore, the panel demonstrates how governments are coming together with the private sector to overcome funding constraints in order to finance and build projects that can improve quality of life – both solving immediate needs and planning for future societal demands.

KPMG International’s ‘Infrastructure 100: World Markets Report highlights key trends driving infrastructure investment around the world. In the report, a global panel of industry experts identifies 100 of the world’s most innovative, impactful infrastructure projects. Furthermore, the panel demonstrates how governments are coming together with the private sector to overcome funding constraints in order to finance and build projects that can improve quality of life – both solving immediate needs and planning for future societal demands. Of all the 100 projects listed in the 2014 KPMG-report, 27 projects are in the sector of energy and natural resources. Besides the IceLink, these projects are for example the Alaska LNG Project, the UK Hinkley Point C Nuclear Power Station, and Russia-China Gas Pipeline.

Of all the 100 projects listed in the 2014 KPMG-report, 27 projects are in the sector of energy and natural resources. Besides the IceLink, these projects are for example the Alaska LNG Project, the UK Hinkley Point C Nuclear Power Station, and Russia-China Gas Pipeline.