Data centers in Iceland

In 2007, a benchmarking study by PricewaterhouseCoopers (PWC) showed Iceland to be a favorable location for new data centre activity. The report concluded with Iceland being supportive and welcoming in the respect of issues as governmental legislation, immigration and permits.

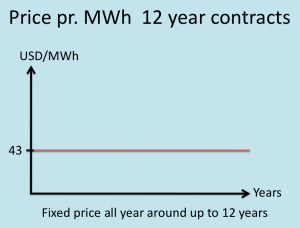

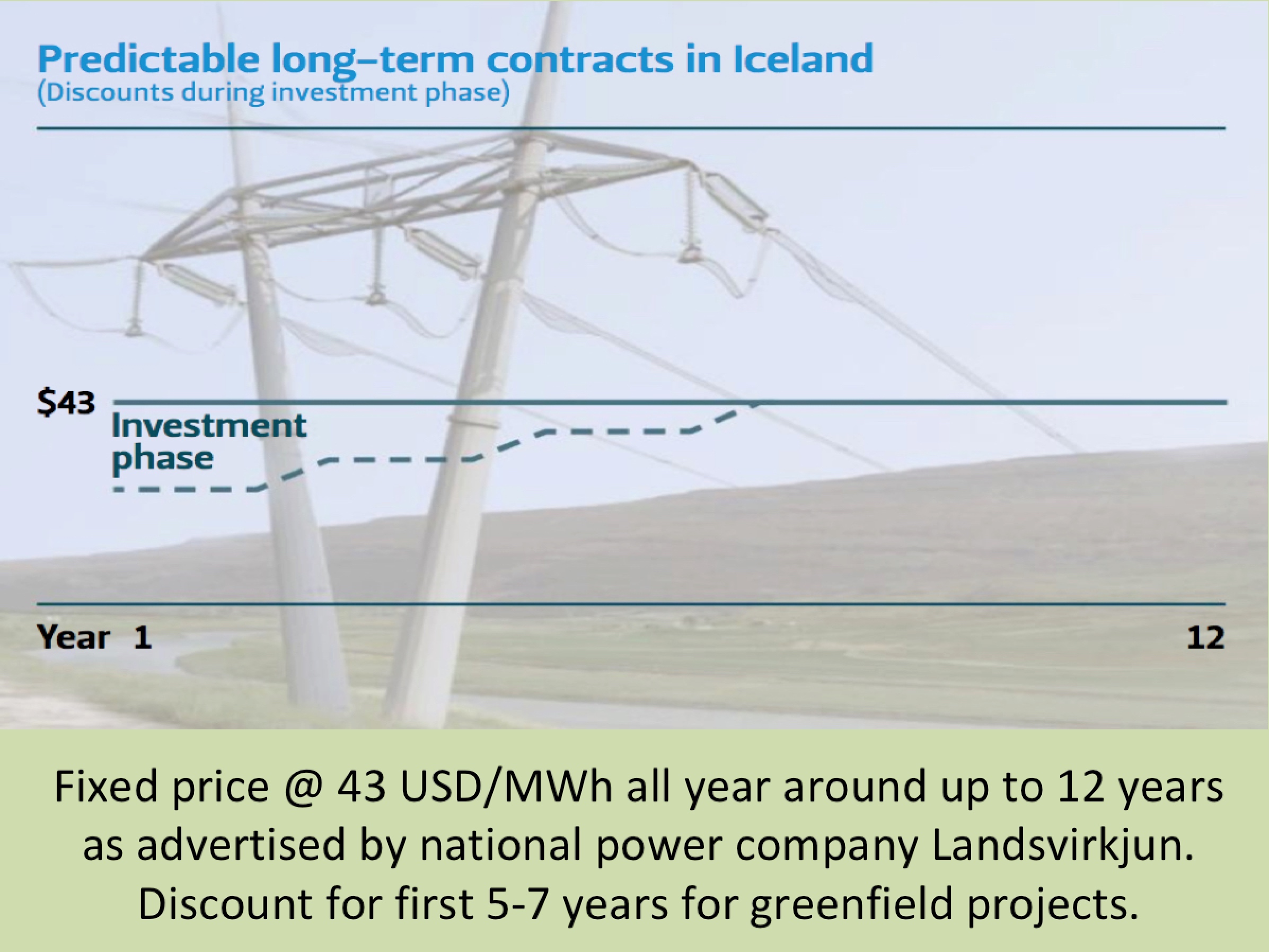

Operational cost for data centres in Iceland is minimum due to the low cost cooling and electricity. Presently, the Icelandic power company Landsvirkjun is offering electricity contracts at the price of 43 USD/MWh. Those competitive rates are available as fixed for up to 12 years. Furthermore, Iceland has significantly less of a security risk than almost any other Western or emerging countries. Its geographic location, low population density and lowered post-Cold War strategic value make it an unlikely target for either external or internal forces.

The Icelandic infrastructure for telecommunications networks and services is highly advanced. Mobile phone and Internet penetration in Iceland are among the highest in the world. Iceland is linked with Europe and North America via number of fiber-optic submarine systems. They are Farice-1 to the UK (with a capacity of 0.72 terabits per second and was originally installation in 2003), the Danice cable to Denmark and the Netherlands (with a capacity of 5.1 terabits per second), and Greenland Connect which connects Iceland to Canada and the Northeast United States (with a total capacity of 1.9 terabits per second). Additionally, the new Emerald Express trans-Atlantic cable (with a connection to Iceland) is scheduled to be ready for service before end of this year (2013).

The Icelandic infrastructure for telecommunications networks and services is highly advanced. Mobile phone and Internet penetration in Iceland are among the highest in the world. Iceland is linked with Europe and North America via number of fiber-optic submarine systems. They are Farice-1 to the UK (with a capacity of 0.72 terabits per second and was originally installation in 2003), the Danice cable to Denmark and the Netherlands (with a capacity of 5.1 terabits per second), and Greenland Connect which connects Iceland to Canada and the Northeast United States (with a total capacity of 1.9 terabits per second). Additionally, the new Emerald Express trans-Atlantic cable (with a connection to Iceland) is scheduled to be ready for service before end of this year (2013).

Verne Global and Thor Data Center are examples of new data-centres that have started operation in Iceland in recent years. Besides running on low-cost 100% renewable energy, the growing data-center industry in Iceland is also enjoying a major upgrade of the international submarine telecom capacity between Iceland and mainland Europe

Verne Global is a company that owns and operates a data center campus in Keflavik in Southwest Iceland. The 18-hectare (approximately 45-acre) Verne Global data centre complex is just west of Reykjavik, the capital of Iceland, minutes from Keflavík International Airport. Verne Global’s facility has been designed to fully utilise Iceland’s unique environmental power advantages: 100% powered by renewable energy resources and 100% cooled by the natural environment of Iceland, without the use of chillers or compressors.

Verne Global is a company that owns and operates a data center campus in Keflavik in Southwest Iceland. The 18-hectare (approximately 45-acre) Verne Global data centre complex is just west of Reykjavik, the capital of Iceland, minutes from Keflavík International Airport. Verne Global’s facility has been designed to fully utilise Iceland’s unique environmental power advantages: 100% powered by renewable energy resources and 100% cooled by the natural environment of Iceland, without the use of chillers or compressors.

The largest investor in Verne is the UK investment foundation Wellcome Trust. Verne Global offers data centre decision makers a 100% carbon neutral and affordable power solution with a very precise pricing predictability, a range of server density options and efficiency without extra expense, using natural cooling. The customers of Verne Global customers range in size from those requiring multi-kilowatts to multi-megawatts. With its headquarters in the United Kingdom, Verne Global is led by an experienced team with proven success in the data centre industry.

Thor Data Center (THORDC) in Hafnarfjordur is owned by the Nordic IT company Advania. The Thor Data Center facility is located 10 minutes from Reykjavik, and a 30 minute drive from Keflavik International Airport. Due to the physical and natural elements in Iceland and the specific datacenter design, Thor Data Center is claimed to be one of the most energy efficient data centers in the world. It is powered by clean renewable hydro- and geothermal energy sources and offers unique value proposition for companies demanding a reliant and cost effective hosting service in a 100% green, zero carbon footprint environment.

Thor Data Center (THORDC) in Hafnarfjordur is owned by the Nordic IT company Advania. The Thor Data Center facility is located 10 minutes from Reykjavik, and a 30 minute drive from Keflavik International Airport. Due to the physical and natural elements in Iceland and the specific datacenter design, Thor Data Center is claimed to be one of the most energy efficient data centers in the world. It is powered by clean renewable hydro- and geothermal energy sources and offers unique value proposition for companies demanding a reliant and cost effective hosting service in a 100% green, zero carbon footprint environment.