Gaining from the European green drivers

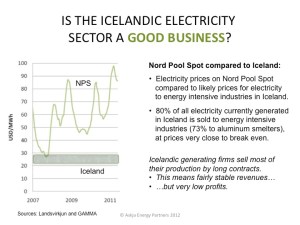

Electricity prices in Iceland are substantially lower than anywhere else in Europe. While common wholesale prices for electricity in Iceland are equivalent to 25-30 €/MWh, the wholesale prices in Europe are often double that and even more. This winter, for example, the average wholesale price at the European Power Exchange (EPEX SPOT) has been close to 50 €/MWh.

This means that if Iceland would have an electric cable connection with Europe, electricity could be sold from Iceland at a much higher price than being possible in the small Icelandic market. This makes the European continent, Scandinavia and the United Kingdom a very interesting market for Icelandic generating firms.

STRONG DRIVERS:

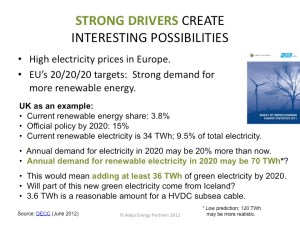

High electricity prices in Europe are not the only driver, creating more demand for Icelandic electricity. Almost all electricity in Iceland is generated by utilizing renewable sources (hydro- and geothermal power). The European Union (EU) has adopted a binding plan to greatly increase the share of renewable energy. According to EU’s Renewable Energy Directive, the Union is going to reach a 20% renewable energy target for 2020 – more than double the 2010 level of 9.8% – as well as a 10% share of renewable energy in the transport sector. The targets will help to cut greenhouse gas emissions and – what may be even stronger incentive – reduce the EU’s dependence on imported energy.

High electricity prices in Europe are not the only driver, creating more demand for Icelandic electricity. Almost all electricity in Iceland is generated by utilizing renewable sources (hydro- and geothermal power). The European Union (EU) has adopted a binding plan to greatly increase the share of renewable energy. According to EU’s Renewable Energy Directive, the Union is going to reach a 20% renewable energy target for 2020 – more than double the 2010 level of 9.8% – as well as a 10% share of renewable energy in the transport sector. The targets will help to cut greenhouse gas emissions and – what may be even stronger incentive – reduce the EU’s dependence on imported energy.

According to the Directive, the member states have taken on binding national targets for raising the share of renewable energy in their energy consumption by 2020. These targets range from 10% in Malta to 49% in Sweden. The national targets will enable the EU as a whole to reach its 20% renewable energy target for 2020 – more than double the 2010 level of 9.8% – as well as a 10% share of renewable energy in the transport sector.

UK AS EN EXAMPLE:

It is noteworthy that to be able to reach the targets, it is expected that for example the United Kingdom needs to add more than 170 TWh of annual renewable energy by 2020 (UK needs to go from present less than 60 TWh to approximately 230 TWh by 2020). This is according to the 2011 UK Renewable Energy Roadmap (pdf) and the 2012 Update (pdf).

It is noteworthy that to be able to reach the targets, it is expected that for example the United Kingdom needs to add more than 170 TWh of annual renewable energy by 2020 (UK needs to go from present less than 60 TWh to approximately 230 TWh by 2020). This is according to the 2011 UK Renewable Energy Roadmap (pdf) and the 2012 Update (pdf).

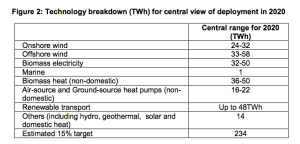

It is not clear how large share new renewable electricity will be of this total renewable energy addition of 170 TWh. However, from the 2011 UK Renewable Energy Roadmap it can be expected that the goal for 2020 may be somewhere between 104-155 TWh of annual renewable electricity generation (as described in a table marked as figure 2 in the Roadmap; shown here above). The current annual renewable electricity generation in the UK is somewhere between 34-38 TWh. Thus, the goal of 104-155 TWh of total electricity from renewable sources by 2020, will call for a new annual renewable electricity production of 66-121 TWh. Possibly, it would be fair to say that the UK needs to add close to 100 TWh to its annual renewable electricity generation. And this is to happen within seven years from now.

HOW ICELAND CAN PLAY A ROLE:

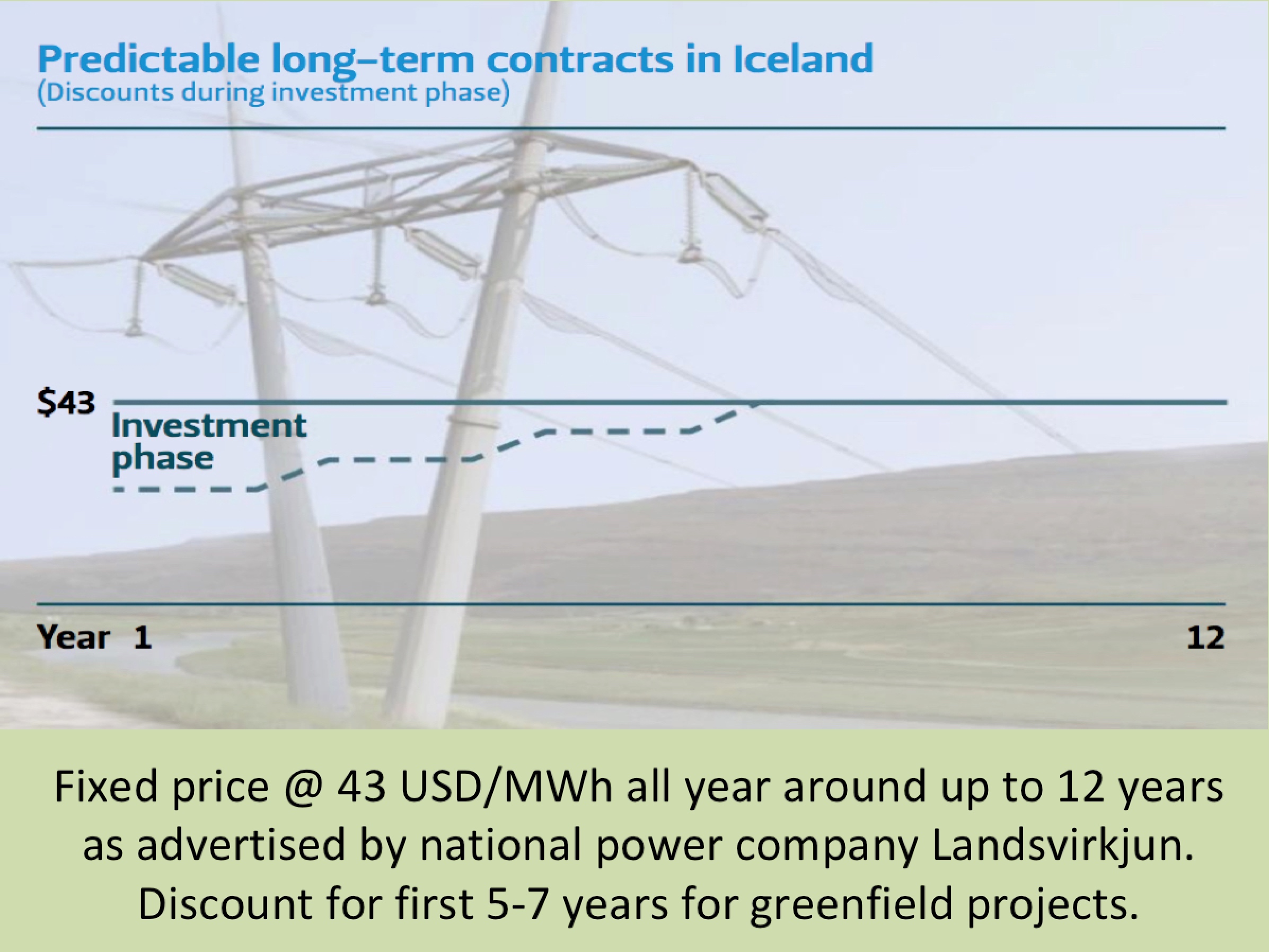

EU’s plan for increasing renewable energy allows the member states to import renewable energy from other countries. Iceland can offer substantial amount of electricity from renewable sources at very competitive prices (currently, the Icelandic power company Landsvirkjun offers new 12 year contracts at 43 USD/MWH, which equals approximately 32 €/MWh). It may be totally realistic that some of UK’s new renewable electricity will come from Iceland.

Iceland’s hydro- and geothermal power is less costly than for example new wind farms in the UK. In addition, Icelandic hydro- and geothermal power is a stable base-load power, unlike wind and unlike solar.

Iceland’s hydro- and geothermal power is less costly than for example new wind farms in the UK. In addition, Icelandic hydro- and geothermal power is a stable base-load power, unlike wind and unlike solar.

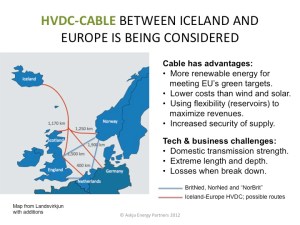

An electric cable between Iceland and the UK might be a win-win project. UK would gain access to reliable base-load renewable electricity. Icelandic power companies would increase their profits and could utilize the cable to import electricity from the UK when prices there are low (for example during the night, when demand is minimal).

Such a high voltage direct current (HVDC) cable is currently being seriously considered by a group of Icelandic power companies and other stakeholders. This would be a technically and financially complicated project and probably it will take a couple years until any decision will be taken on the matter. For more information you are welcome to contacts us at Askja Energy directly with your inquiries.