Premature story in the Guardian

Yesterday, the Guardian published a story about Iceland seeking UK funding for subsea cable project. This is a somewhat premature statement by the Guardian. It is certainly true that the possibility of an electric cable between Iceland and the UK is being considered. However, no formal decision on such a project has been taken yet.

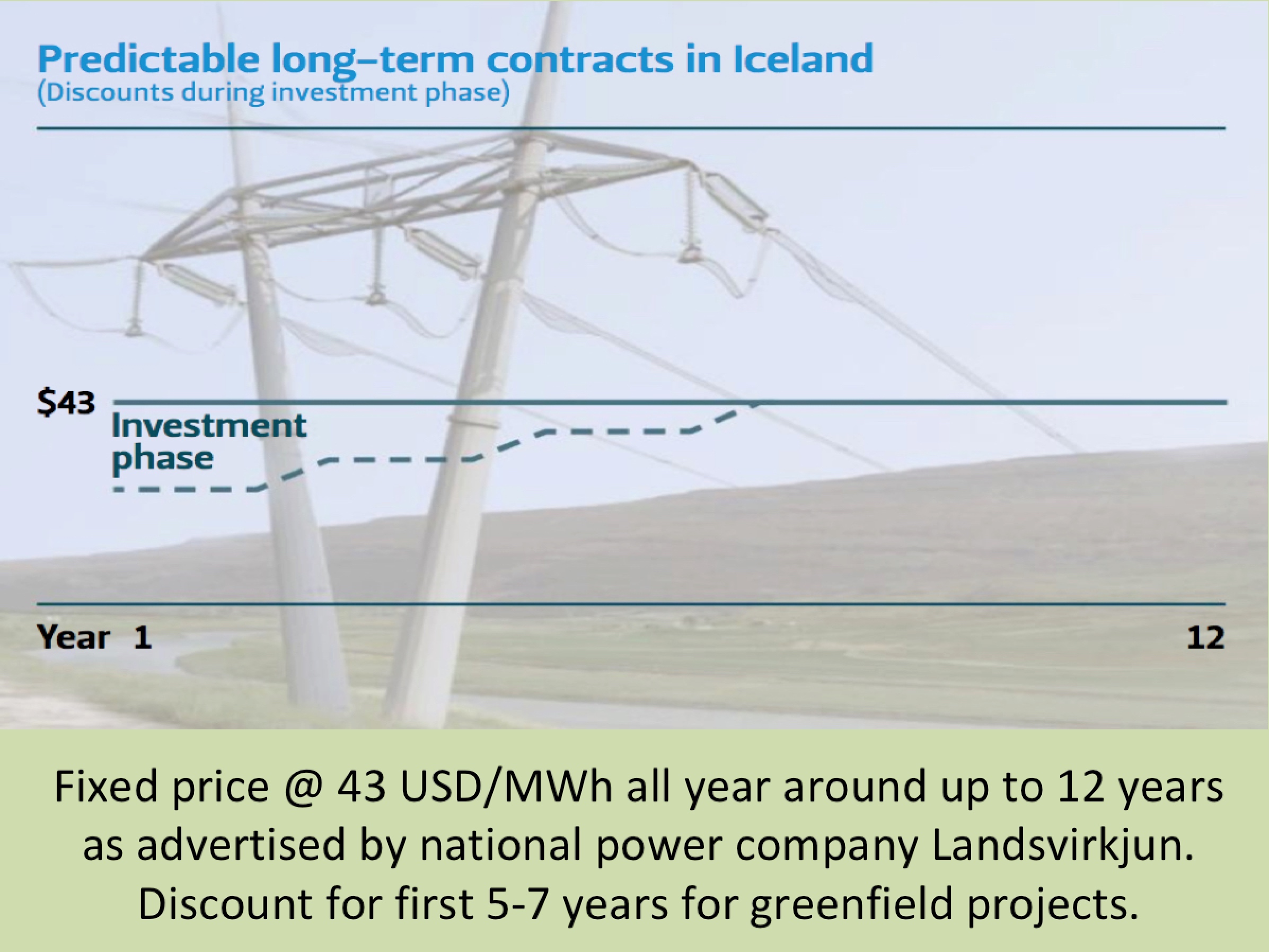

The Guardian correctly states that such a project could possibly deliver 5 TWh’s of green electrity a year to Britain. And the price of the electricity could be very competitive (lower than from British offshore wind farms). It is also correct that all the electricity from Iceland would be generated by harnessing renewable natural sources (especially hydropower, but also geothermal and wind).

The project would most likely strongly appeal to the UK. The Guardian correctly points out that the highly reliable potential energy in Iceland’s hydro dams can be seen as neatly dovetailing with Britain’s expanding, but unpredictable, wind power generation:

“As wind has become an increasing component of UK electricity generation, those tasked with matching UK supply with demand are increasingly facing a difficulty when usage spikes at times of when wind speeds drop. Few sources of generation, other than hydropower, can be brought on-stream at short notice to cover for lulls in wind.”

According to the Guardian, Iceland’s president Mr. Ólafur Ragnar Grímsson is expected this week to call on the British government to provide financial support for the construction of the subsea electricity cable – which will be the longest in the world – linking the electricity grid’s of Iceland and the UK. Actually, it is more likely that the president will urge the British government to further cooperate with Iceland in necessary research and development that will be necessary if the cable is to be realized.

As mentioned in the Guardian’s article, the governments of Iceland and the UK have already stared exploring proposals for a cable, after a ministerial meeting in May last year (2012). It would be a sensible step to strengthen the cooperation between the two countries in preparing to link the countries with an electric cable. Hopefully, the necessary cost analysis and research on for example the sea-bed can take place soon. When this will be finished, the financing of the cable may become a relevant issue.

As mentioned in the Guardian’s article, the governments of Iceland and the UK have already stared exploring proposals for a cable, after a ministerial meeting in May last year (2012). It would be a sensible step to strengthen the cooperation between the two countries in preparing to link the countries with an electric cable. Hopefully, the necessary cost analysis and research on for example the sea-bed can take place soon. When this will be finished, the financing of the cable may become a relevant issue.

NB: The Guardian says that the length of the cable would be 10,000 km. This is of course wrong; an electric cable between Iceland and the UK would be close to 1,200 km (somewhere between 1,000 and 1,500 km). The Guardian also says that the electricity industry in Iceland produces 12 GWh of electricity annually. The correct number is of course much higher or close to 17.2 TWh (17,200 GWh). Hopefully, the Guardian will correct their numbers. More information about the Icelandic power sector can be found here.